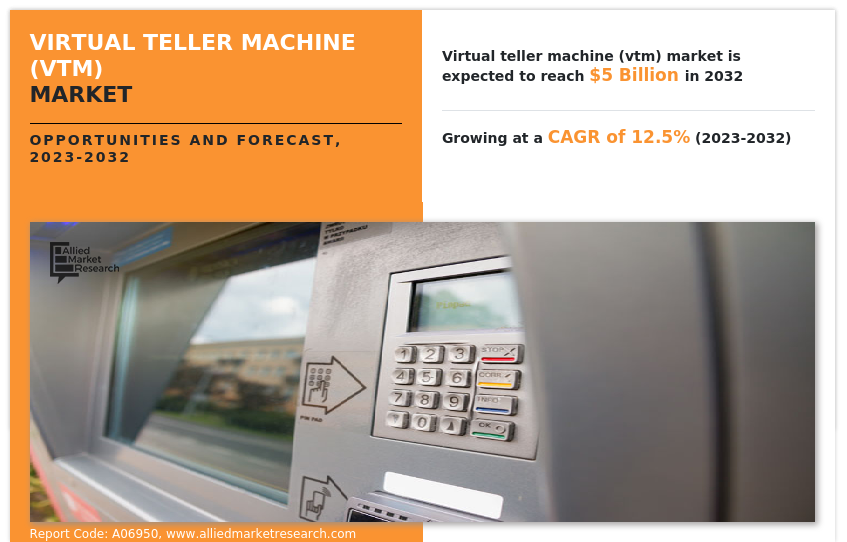

According to a new report published by Allied Market Research, titled, “Virtual Teller Machine (VTM) Market, by Offering (Hardware, Software, Service), by Deployment (On-site, Off-site, Others), by Provider (Bank and Financial Institutions, Managed Service Provider): Global Opportunity Analysis and Industry Forecast, 2023-2032. ” The virtual teller machine (vtm) market was valued at $1.6 billion in 2022, and is estimated to reach $5 billion by 2032, growing at a CAGR of 12.5% from 2023 to 2032.

Research Methodology

Increase in demand for cost-effective and secure solutions and surge in adoption of automation solutions in the banking sector is boosting the growth of the global virtual teller machine (VTM) market. In addition, increase in adoption of multifunctionality features in VTMs is positively impacts growth of the virtual teller machine (VTM) market. However, security issues and privacy concerns and high implementation cost is hampering the virtual teller machine (VTM) market growth. On the contrary, increase in adoption of video banking technology is expected to offer remunerative opportunities for expansion of the virtual teller machine (VTM) market during the forecast period.

Get PDF Sample: https://www.alliedmarketresearch.com/request-sample/7315

Region Analysis:

The Virtual Teller Machine (VTM) market is examined across four key regions: North America, Europe, Asia-Pacific, and LAMEA. North America analysis includes the U.S. and Canada. In Europe, the market trends in the UK, Germany, France, Italy, Spain, Netherlands, and the rest of Europe are explored. Asia-Pacific covers China, India, Japan, Australia, Singapore, and the rest of the region. LAMEA includes Latin America, Middle East, and Africa.

The Global Virtual Teller Machine (VTM) Definition:

Virtual teller machines are an efficient tool for financial and non-financial institutions to provide convenient and customized services to their customers in real-time. In addition, customers can perform banking transactions through virtual teller machines, while interacting with tellers located at call centers or other branches through video conferencing. Moreover, Interactive teller machines are a great example of modernization in personal financing. These machines are essentially evolved ATMs, and while somewhat limited in utility, VTM’s are providing an interesting option for financial institutions to serve customers in extremely rural or urban areas.

Inquire Here Before Buying: https://www.alliedmarketresearch.com/virtual-teller-machine-vtm-market/purchase-options

Virtual Teller Machine (VTM) Market Segmentation:

By Offering:

- Hardware

- Software

- Service

By Deployment:

- On-site

- Off-site

- Others

By Provider:

- Bank and Financial Institutions

- Managed Service Provider

By Region:

- North America (U.S., Canada)

- Europe (UK, Germany, France, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the virtual teller machine (VTM) market segmentation, current trends, estimations, and dynamics of the virtual teller machine market analysis from 2023 to 2032 to identify the prevailing virtual teller machine market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the virtual teller machine market segmentation assists to determine the prevailing virtual teller machine (VTM) market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global virtual teller machine (VTM) market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the virtual teller machine (VTM) market players.

- The report includes the virtual teller machine (VTM) market analysis of the regional as well as global virtual teller machine (VTM) market trends, key players, virtual teller machine (VTM) market segments, application areas, and market growth strategies.

If you have any special requirements, please let us know: https://www.alliedmarketresearch.com/request-for-customization/7315

Important Questions Answered in the Report:

What are the key factors driving the growth of the global Virtual Teller Machine VTM market?

Which region held the largest share in the global Virtual Teller Machine VTM market?

What are the advantages of selling Virtual Teller Machine VTM?

Who are the leading players in the global Virtual Teller Machine VTM market?

What is the CAGR of the market during the forecast timeframe?

Top Trending Report:

Blockchain in Insurance Market

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Wilmington, Delaware. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports Insights” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

1209 Orange Street,

Corporation Trust Center,

Wilmington,

New Castle,

Delaware 19801 USA.

Int’l: +1-503-894-6022 Toll Free: +1-800-792-5285

UK: +44-845-528-1300

India (Pune): +91-20-66346060 Fax: +1-800-792-5285 help@alliedmarketresearch.com