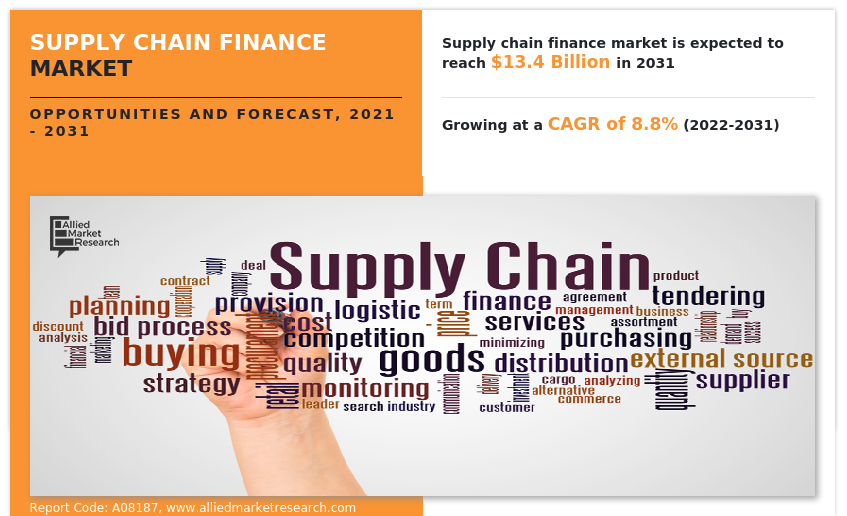

According to the report published by Allied Market Research, the global supply chain finance market generated $6 billion in 2021, and is projected to reach $13.4 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape, and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners, and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.

Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/8552

The report offers a detailed segmentation of the global supply chain finance market based on offering, provider, application, end user, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on the fastest-growing segments and highest revenue generation that is mentioned in the report.

Based on offering, the export and import bills segment held the major market share in 2021, holding nearly two-fifths of the global supply chain finance market share, and is expected to maintain its leadership status during the forecast period. However, the shipping guarantees segment, is expected to cite the fastest CAGR of 13.1% during the forecast period.

On the basis of provider, the banks segment held the largest market share in 2021, accounting for nearly 90% of the global supply chain finance market share, and is expected to maintain its leadership status during the forecast period. Nevertheless, the trade finance house segment, is expected to cite the highest CAGR of 14.2% during the forecast period.

In terms of application, the domestic segment held the major market share in 2021, contributing to nearly fourth-fifths of the global supply chain finance market share, and is expected to maintain its leadership position during the forecast period. However, the international segment, is expected to cite the fastest CAGR of 11.6% during the forecast period.

Based on end user, the large enterprises segment held the major market share in 2021, contributing to nearly two-thirds of the global supply chain finance market share, and is expected to maintain its leadership position during the forecast period. However, the small and medium-sized enterprises segment, is expected to cite the fastest CAGR of 11.2% during the forecast period.

Interested to Procure the Data? Inquire Here@

Region-wise, the Asia-Pacific region held the major market share in 2021, holding over two-fifths of the global supply chain finance market share and is expected to maintain its leadership status during the forecast period. Moreover, the same segment is expected to cite the fastest CAGR of 11.5% during the forecast period. The report also analyses other regions such as North America, Europe, and LAMEA.

The key players analyzed in the global supply chain finance market report include Asian Development Bank, BNP Paribas Group, Bank of America Corporation, Citigroup, Inc., Eulers Herms (Allianz Trade), HSBC Group, JPMorgan Chase & Co., Mitsubishi UFJ Financial Group, Inc., Royal Bank of Scotland plc, and Standard Chartered plc.

The report analyzes these key players in the global supply chain finance market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance, and operating segments by prominent players in the market.

KEY BENEFITS FOR STAKEHOLDERS

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the data analytics in banking market analysis from 2021 to 2031 to identify the prevailing supply chain finance market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities in the supply chain finance market forecast.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the supply chain finance market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global supply chain finance market trends, key players, market segments, application areas, and market growth strategies.

Key Market Segments

Offering

- Export and Import Bills

- Letter of Credit

- Performance Bonds

- Shipping Guarantees

- Others

Provider

- Banks

- Trade Finance House

- Others

Application

- Domestic

- International

End User

- Large Enterprises

- Small and Medium-sized Enterprises

By Region

- North America (U.S., Canada)

- Europe (Germany, France, UK, Italy, Spain, Rest of Europe)

- Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Buy This Research Report – https://bit.ly/3WHy9GB

Trending Reports in BFSI Industry:

Insurance Brokerage Market https://www.alliedmarketresearch.com/insurance-brokerage-market-A10350

Commercial Property Insurance Market https://www.alliedmarketresearch.com/commercial-property-insurance-market-A11622

Buy Now Pay Later Market https://www.alliedmarketresearch.com/buy-now-pay-later-market-A12528

B2B Payments Market https://www.alliedmarketresearch.com/b2b-payments-market-A08183

Travel Insurance Market https://www.alliedmarketresearch.com/travel-insurance-market

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.