Claims processing software is beneficial as it helps to effectively manage and analyze information pertaining to claims. The claims automation software helps to automate the entire system of claims management by reducing the settlement time and enhancing customer service. It provides faster and intuitive access to claims data records, which helps in making effective decisions. Therefore, these are the key factors that boost the global claims processing software market growth. However, higher startup cost for claims processing software restricts growth of the claims processing software market. Conversely, claim processing platforms can help insurance companies and risk managers to reduce exposure, increase employee productivity, reduce claim processing cycle time, and provide better customer service. Moreover, it helps enhance quality of service, which gives a competitive edge over other companies. Therefore, these factors are expected to create an immense opportunity for the market in the coming years.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/7299

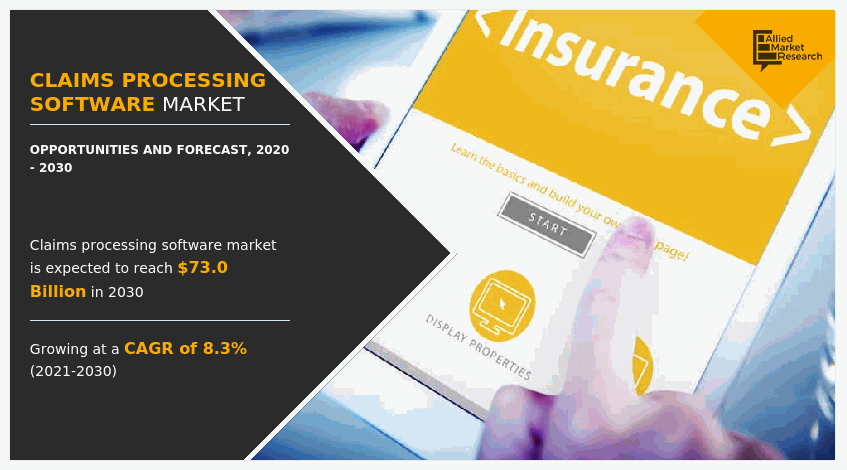

The claims processing software market size was valued at $33.9 billion in 2020, and is estimated to reach $73.0 billion by 2030, growing at a CAGR of 8.3% from 2021 to 2030.

On the basis of end user, the insurance companies segment generated the highest revenue in 2020. This is attributed to the fact that insurance claims management software provides faster access to claims data and helps insurance companies to operate with efficiency. The software also allows tracking of claim processes performance resulting in improved process visibility. This increases effectiveness of managing claims as they are quickly finalized and decisions are made faster. Furthermore, the agents & brokers segment is expected to exhibit highest growth during the forecast period. This is attributed to the fact that insurance claims processing software is commonly used by both independent and enterprise insurance agencies to support agents and brokers as they manage claims of clients.

Buy Now and Get Discount: https://www.alliedmarketresearch.com/checkout-final/6e5f13db869f30e33c91ac1a2fadb5fe

Region wise, North America generated the highest revenue in 2020. This is attributed to the fact that North America has witnessed an increased rate of adoption of cloud-based solutions, owing to increase in digitization in insurance and e-commerce sectors, which drives growth prospects for this regional market significantly during the forecast period. Moreover, Asia-Pacific is attributed to grow significantly during the forecast period. This is attributed to growth in digitization and strong technological advancements in the region.

The claims processing software industry has been positively impacted by the COVID-19 outbreak. This is attributed to the fact that consumer trends toward claims processing software are changing and key players in the market are adopting claims processing software for faster claims processing platforms & real-time interaction with consumers. Reduced claim processing time makes it easy for employees to quickly respond to customer queries. The software provides good visibility of the claim process, which enables users to make improvements and use enhanced resources to provide better results. The software also provides an effective user-friendly interface with contact-sensitive help instructions and tutorials for various features, which makes it easy to learn quickly.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/7299

Key findings of the study

By component, the software segment led the claims processing software market share, in terms of revenue in 2020.

By enterprise size, the large enterprise size segment accounted for the highest claims processing software market trends in 2020.

By region, North America generated the highest revenue in 2020.

The key players profiled in the claims processing software market analysis are A1 Enterprise, Duck Creek Technologies, FINEOS, Hyland Software, Inc., Hawksoft, Inc., HIPPAsuite, Newgen Software Technologies Limited, Pegasystems Inc., Quick Silver, and VENTIV TECHNOLOGY. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Trending Reports:

Stock Market Software Market: https://www.alliedmarketresearch.com/stock-market-A14675

Financial Planning Software Market: https://www.alliedmarketresearch.com/financial-planning-software-market-A16422

Loan Compliance Management Software Market: https://www.alliedmarketresearch.com/loan-compliance-management-software-market-A08299

Budgeting Software Market: https://www.alliedmarketresearch.com/budgeting-software-market-A11766

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.