Takaful insurance, also known as ‘Islamic insurance’, is mainly based on unity and cooperation. It is a mutual agreement between a group of people who are willing to compensate for harm and loss from a fund they will donate collectively. The major shareholder of Takaful insurance is BIMB Holdings Berhad (BHB) with 59.19% shareholding in the market.

Get Sample PDF: https://www.alliedmarketresearch.com/request-sample/12200

Report Summary:

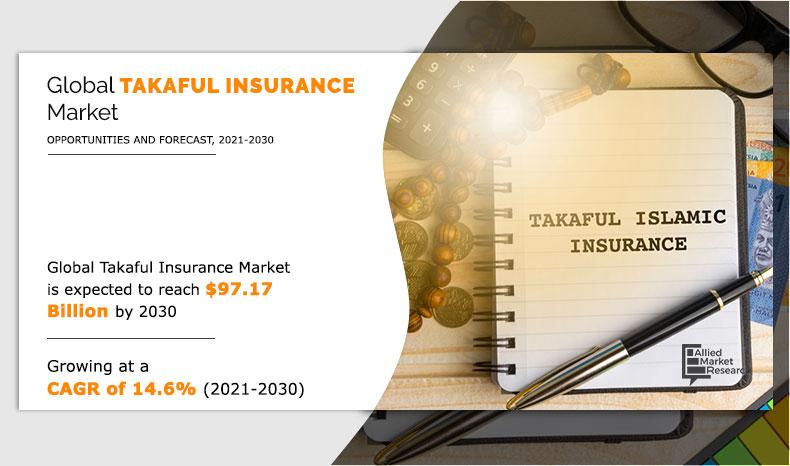

Allied Market Research published a report on takaful insurance market which states, “Takaful Insurance Market By Distribution Channel (Agents & Brokers, Banks, Direct Response and Others), Type (Family Takaful and General Takaful), and Application (Personal and Commercial): Global Opportunity Analysis and Industry Forecast, 2021-2030”

The report offers valuable information on the research methodology, market dynamics, significant market segments, major investment pockets, key market players, application areas, market size and share analysis, market forecast, and competitive analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the takaful insurance outlook.

The analysis mentioned in the takaful insurance report combines qualitative and quantitative information about the market’s potential in the future, challenges, and risks related to the market. The study is based on a variety of credible explanations, including interviews with industry experts, reliable statistics, and provisional perception. Primary research is performed by contacting participants via phone calls, emails, formal interactions, professional networks, and referrals.

Inquire Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/12200

Principles of Takaful Insurance:

· Takaful insurance operate in accordance with the Islamic cooperative principle.

· Each contribution to the Takaful fund is based on what is being covered and for how long.

· Members donate a sum of money and the committee approves their sharing ratio for each year.

· Also, the member’s contribution considers the member business’s own situation and risk profile.

· Any loss and surplus from the Takaful fund are shared among the policy holders and liabilities are distributed according to an agreed community pooling system.

· Uncertainty is abolished with respect to subscription and compensation.

Market Players:

The prominent players operating in the global takaful insurance market include –

- Abu Dhabi National Takaful Co.

- Allianz

- AMAN Insurance

- Islamic Insurance

- Prudential BSN Takaful Berhad

- Qatar Islamic Insurance

- SALAMA Islamic Arab Insurance Company

- Syarikat Takaful Brunei Darussalam

- Takaful International

- Zurich Malaysia

Request Customization : https://www.alliedmarketresearch.com/request-for-customization/12200

Segment Analysis:

Furthermore, the report discusses segments and subsegments of the takaful insurance market. It also discusses the major shareholder and fastest growing segments of each category. The smart finance hardware market is segmented into distribution channel, type, application, and region.

- By distribution channel, the takaful insurance market is fragmented into agents & brokers, banks, direct response and others.

- By type, it is categorized into family takaful and general takaful.

- Based on application, the market is divided into personal and commercial.

- Region wise, the market is analyzed across GCC, Asia, MEA and the rest of the World.

Related Reports:

Gadget Insurance Market : https://www.alliedmarketresearch.com/gadget-insurance-market-A11629

P&C Insurance Software Market : https://www.alliedmarketresearch.com/p&c-insurance-software-market-A31324

Italy B2B2C Insurance Market : https://www.alliedmarketresearch.com/italy-b2b2c-insurance-market-A31484

Reinsurance Market : https://www.alliedmarketresearch.com/reinsurance-market-A06288

Medical Professional Liability Insurance Market : https://www.alliedmarketresearch.com/medical-professional-liability-insurance-market-A30183

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com