The increasing investments by governments in industrial and infrastructural projects is the major factor driving the growth of the real estate investment market.

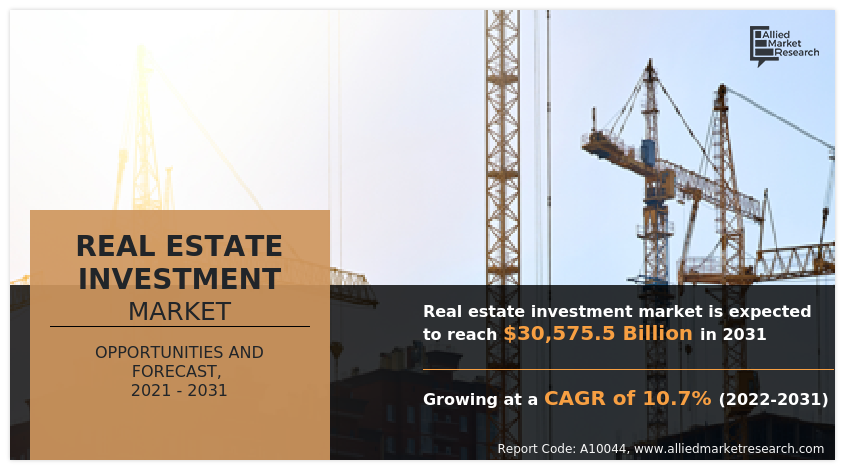

The real estate investment market was valued at $11444.67 billion in 2021, and is estimated to reach $30575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/10409

Growth in urbanization and population drives the commercial and industrial sector, which in turn is expected to propel the demand for real estate investment in the coming years. In addition, the growth is mainly due to rise in demand for various properties such as residential, commercial, and industrial. Moreover, government initiatives to open the real estate sector for foreign direct investment boost the growth for real estate investment services. In addition, growth in technological innovations in the real estate investment industry is propelling the adoption of virtual real estate investment. Thus, this factor notably drives the growth of real estate investment market.

The real estate investment companies are focusing on business expansion and new projects as a strategy to increase their real estate market shares. For instance, in July 2019, CBRE Group, Inc., a U.S. based commercial real estate investment firm acquired shares of UK-based Telford Homes Plc. The acquisition aims to expand footprints in the UK and Europe. Similarly, Life House, a vertically integrated hotel company has secured around $100 million in Blue Flag Partners for its business expansion through the acquisition of additional hotels. Thus, this benefits the real estate investment market growth.

Based on property type, the residential investment segment acquired a major share in the real estate investment market in 2021. This is attributed to increase in number of residential complexes, and development of infrastructure, especially in emerging economies such as India, China, Bangladesh, and Africa, are expected to drive the market growth. In addition, government programs for affordable housing help boost the demand for residential properties.

Buy Now: https://www.alliedmarketresearch.com/checkout-final/933b4c0e5c78ebedad8dc84c58c82b26

By region, Asia-Pacific is expected to grow at the highest CAGR during the forecast period in real estate investment market. This is attributed to the fact that Asia-Pacific is an emerging economy, where real estate market is witnessing growth, owing to increased infrastructure development projects. Further, economic recovery and rise in construction demand are the significant real estate investment market trends.

The COVID-19 outbreak has impacted the life & businesses of all the individuals globally. In addition, many investors’ perspectives and habits changed as a result of the crisis’ volatility. As the pandemic progressed in 2020, investors began to doubt in the market’s prospects owing to volatility in the market and increased fluctuation in investment decisions. As a result of the uncertain future, real estate investors throughout the world have shifted their willingness to accept risks, with a higher fraction of them moving a portion of their portfolios to lower risk assets. This boosted the growth of real estate investment industry during the pandemic.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/10409

KEY FINDINGS OF THE STUDY

By distribution channel, the public REIT segment led the real estate investment market share in terms of revenue in 2021.

By property type, the industrial investment segment is expected to exhibit the fastest growth rate during the forecast period.

Region-wise, North America generated the highest revenue in real estate investment market size in 2021.

The key players operating in the real estate investment market analysis include ATC IP LLC, AVALONBAY, INC., Ayala Land, Inc., Brookfield Asset Management Inc., Gecina, Link Asset Management Limited, Prologis, Inc., SEGRO, Simon Property Group, L.P., CBRE, Jones Lang LaSalle IP, Inc., New World Development Company Limited, Colliers, NMRK, Welltower, Cadre, and Roofstock, Inc. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Regional Trending Reports:

Japan Real Estate Investment Market: https://www.alliedmarketresearch.com/japan-real-estate-investment-market-A97463

U.S. Real Estate Investment Market: https://www.alliedmarketresearch.com/u-s-real-estate-investment-market-A97449

Europe Real Estate Investment Market: https://www.alliedmarketresearch.com/europe-real-estate-investment-market-A97451

Switzerland Real Estate Investment Market: https://www.alliedmarketresearch.com/switzerland-real-estate-investment-market-A97457

Trending Reports:

Real Estate Loans Market: https://www.alliedmarketresearch.com/real-estate-loans-market-A10048

Loan Management Software Market: https://www.alliedmarketresearch.com/loan-management-software-market-A08185

EMV Smart Cards Market: https://www.alliedmarketresearch.com/emv-smart-cards-market-A14987

Singapore Student Loan Market: https://www.alliedmarketresearch.com/singapore-student-loan-market-A18746

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.