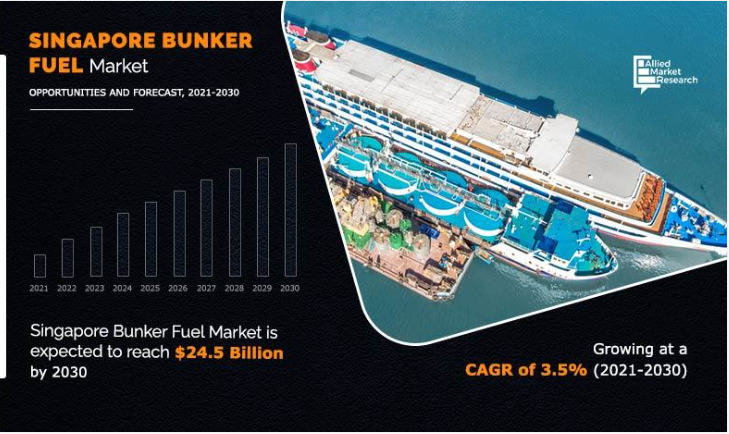

The Singapore bunker fuel market size was valued at $17.6 billion in 2020, and is projected to reach $24.5 billion by 2030, growing at a CAGR of 3.5% from 2021 to 2030. Singapore is one of the world’s largest bunkering ports and is a significant hub for the supply and trading of bunker fuel. Bunker fuel is a type of fuel oil that is used to power ships and is also known as marine fuel.

Singapore is a popular destination for bunker fuel because of its strategic location along major shipping routes, efficient port facilities, and competitive pricing. In addition, Singapore has a well-developed infrastructure for bunkering, with many licensed bunker suppliers and traders operating in the port.

Get a PDF brochure for Industrial Insights and Business Intelligence: https://www.alliedmarketresearch.com/request-sample/14860

The key players operating and profiled in the report include BP Plc., Exxon Mobil Corporation, Equatorial Marine Fuel Management Services Pte. Ltd., Glencore Singapore Pte. Ltd., PetroChina International (Singapore) Pte. Ltd., Royal Dutch Shell Plc., Sentek Marine & Trading Pte. Ltd., SK Energy International Singapore Pte. Ltd., Total Energies, and Vitol Marine Fuels Pte. Ltd.

Other players operating in the value chain of the Singapore bunker fuel market are Global Energy Trading Pte. Ltd., Chevron Singapore Pte. Ltd., Eng Hua Company Pte Ltd., Maersk Oil Trading Singapore Pte Ltd., and others.

The quality of bunker fuel supplied in Singapore is regulated by the Maritime and Port Authority of Singapore (MPA) to ensure that it meets international standards for safety and environmental protection. Bunker fuel suppliers are required to comply with strict regulations on fuel quality, handling, and delivery to ensure that the fuel is safe and reliable for use by ships.

Overall, Singapore’s role as a major bunkering hub is important for the global shipping industry, as it helps to ensure the efficient and reliable supply of bunker fuel to ships operating in the region.

Gas tankers is the fastest-growing application segment in the Singapore bunker fuel market and is expected to grow at a CAGR of 4.1% during 2021–2030.

In 2020, container segment dominated the Singapore bunker fuel market with more than 23.14% of the share, in terms of revenue.

In 2020, the low sulfur fuel oil segment accounted for majority of the market share of the Singapore bunker fuel market, and is expected to maintain its lead during the forecast period.

In 2020, the oil majors segment accounted for around 40.63% of the share in the Singapore bunker fuel market, and is expected to maintain its dominance till the end of the forecast period.

Buy This Report (180 Pages PDF with Insights, Charts, Tables, and Figures): https://bit.ly/3puXLds

In 2020, the large independent distributor segment is accounted for 34.47% market share in 2020, and is anticipated to grow at a rate of 3.9% in terms of revenue, increasing its share in the Singapore bunker fuel market.

Rise in offshore exploration & production (E&P) activity and increase in seaborne trade across the Asia-Pacific region are the factors that drive the growth of the Singapore bunker fuel market during the forecast period.

In addition, IMO’s regulations of sulfur cap for marine fuels are also expected to drive the growth of the bunker fuel market during the analyzed time frame.

Rapid growth of bunkering ports in Asia-Pacific region with the availability of compliant marine fuel is further expected to restrain the growth of the Singapore bunker fuel market in the upcoming years.

COVID-19 impact

The demand for marine fuel has decreased, owing to the COVID-19 pandemic across the world. According to the International Energy Agency (IEA), fuel oil demand for end uses including marine bunker, power generation, and industrial uses is expected to decline by 6.3% in 2020.

Enquiry Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/14860

In addition, high sulfur fuel oil demand has already been collapsed due to IMO regulation along with this COVID-19 pandemic also restrained the Singapore bunker fuel market growth in first 2 quarters of 2020 and increased in the last 2 quarters of 2020. Thus, overall growth of Singapore bunker fuel market seems to be steady in the year 2020.

About Us

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: