Access to large sums of money, shorter loan application processes, and low interest rates drive the growth of the global commercial lending market. The outbreak of the Covid-19 pandemic has had a remarkable impact on the commercial lending market due to rise in commercial and industrial loans as the majority of the businesses suffered losses.

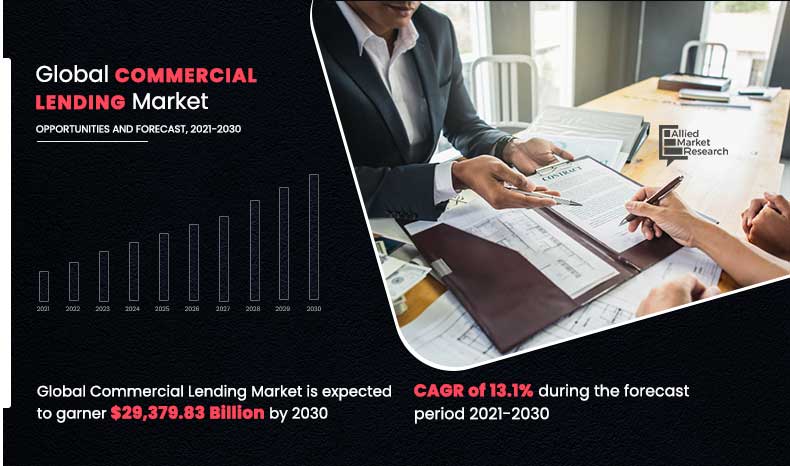

According to the report published by Allied Market Research, the global commercial lending market generated $8.82 trillion in 2020, and is projected to reach $29.38 trillion by 2030, witnessing a CAGR of 13.1% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

Download Sample Report @ https://www.linkedin.com/feed/update/urn:li:activity:6919285588558848000

Pramod Borasi, a Research Analyst, BFSI at Allied Market Research, stated, “Technological advancements along with automation processes in the commercial lending industry has made it convenient for businesses to get loans approved, which propels the market growth.”

COVID-19 Scenario:

- The outbreak of the Covid-19 pandemic has had a remarkable impact on the commercial lending market due to rise in commercial and industrial loans as the majority of the businesses suffered losses.

- Several banks reported that they are overburdened by the rise in commercial loading during the pandemic as firms continue to seek financing.

The report offers detailed segmentation of the global commercial lending market based on type, enterprise size, and region. By type, the secured lending segment held the highest market share in 2020, accounting for nearly three-fifths of the global commercial lending market. In addition, the same segment is expected to register the highest CAGR of 14.6% during the forecast period.

Get a PDF Sample @ https://twitter.com/Allied_MR/status/1513522104020267010

By enterprise size, the large enterprises segment held the lion’s share in 2020, contributing to nearly three-fifths of the global commercial lending market. However, the small & medium sized enterprises segment is estimated to manifest the highest CAGR of 15.4% from 2021 to 2030.

By region, the market across Asia-Pacific, followed by North America, dominated in 2020, holding more than two-fifths of the global commercial lending market. Moreover, the same region is projected to portray the highest CAGR of 15.1% during the forecast period.

Request For Sample Pages @ https://www.facebook.com/alliedmarketresearch/posts/2199867410176477

Major Market Players

- American Express Company

- Credit Suisse

- Fundation Group LLC

- Fundbox

- Funding Circle

- Goldman Sachs

- Kabbage

- LoanBuilder

- Merchant Capital

- OnDeck

Similar Reports:

Peer to Peer Lending Market: https://www.alliedmarketresearch.com/peer-to-peer-lending-market

Commercial Insurance Market: https://www.alliedmarketresearch.com/commercial-insurance-market-A11665

Cryptocurrency Market – https://www.alliedmarketresearch.com/crypto-currency-market

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to offer business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: 1-800-792-5285

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1-855-550-5975

Email: help@alliedmarketresearch.com

Follow us on LinkedIn, Twitter, Facebook, Pinterest, YouTube & Instagram