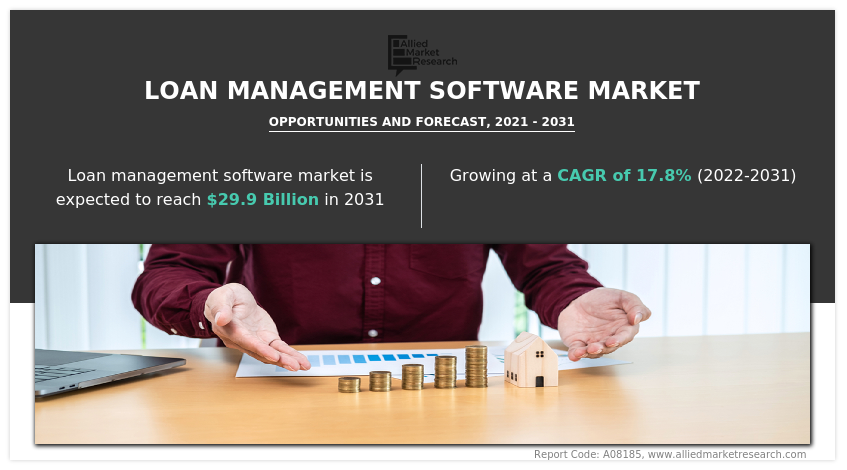

Allied Market Research published a report, titled, “Loan management software market by Component (Solution and Service), Deployment Mode (On-Premise and Cloud), Enterprise Size (Large Enterprises, and Small and Medium-sized Enterprises), and Application (Cash and Liquidity Management, Risk Management, Collateral Management, Loan Origination & Servicing, and Others) End User (Banks, Credit Unions, NBFCs, and Others), And Region (North America, Europe, Asia-Pacific, and LAMEA): Global Opportunity Analysis and Industry Forecast, 2022-2031″ According to the report, the global loan management software industry generated $5.93 billion in 2021, and is estimated to reach $29.86 billion by 2031, witnessing a CAGR of 17.8% from 2022 to 2031. The report offers a detailed analysis of changing market trends, top segments, key investment pockets, value chains, regional landscapes, and competitive scenarios.

Get PDF Sample: https://www.alliedmarketresearch.com/request-sample/8550

Drivers, Restraints, and Opportunities-

Efficiency in lending operations, surge in demand for loan management software, and Loan management software helps to reduce processing times. These factors drive the growth of the global loan management software market. On the other hand, consumer data security concerns and expensive installation of loan management software impede the growth to some extent. However, technological advancement in the field of loan management software is expected to create lucrative opportunities in the industry.

The solution segment to rule the market in 2021-

By component, the solution segment held the major share in 2021, garnering around half of the global loan management software market revenue. Traditional loan management solutions cannot deal with the new-age demands of modern software applications, empowering the need for loan management software solutions in modern business enterprises, thus driving the segment growth. However, the service segment would showcase the fastest CAGR of 20.6% during the forecast period. It helps to examine loan applications, gather and verify information, communicate with lending agencies and beneficiaries, and process loan payments.

The on-premise segment to maintain its dominance during the forecast period-

By deployment mode, the on-premise segment contributed to the highest share in 2021, accounting for around two-fifths of the global loan management software market revenue. This is attributed to the fact that On-premise deployment model for loan management software enables installation of software and permits applications to run on systems present in premises of an organization rather than providing cloud-based servers. These types of solutions offer enhanced security features, which drives their adoption in large-scale organizations. However, the cloud segment would showcase the fastest CAGR of 20.0% throughout the forecast period. This is due to rise in adoption of cloud-based loan management software among both large and mid-sized enterprises majorly drives the market growth.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/8550

The large enterprises segment to dominate by 2031-

By enterprise size, the large enterprises segment accounted for nearly two-thirds of the global loan management software market share in 2021. This is due to the fact that clients in a large organizations are given a flowchart where they can track the loan process. Also, the dashboard keeps them informed with real-time updates. This improves customer visibility. Moreover, it also speeds the time spent to serve a customer. When the clients are served within a short period, and the data is accurately kept, they will be satisfied. The satisfaction leads to loyalty, and thus, they increase their trust in the company. However, the small and medium-sized enterprise segment would display the fastest CAGR of 21.2% throughout the forecast period. This is attributed to the fact that small & medium-sized enterprises require a robust loan processing software to enhance the speed of loan settlement procedure. Furthermore, SMEs frequently need to process their business loans to run their business. Therefore, loan management software reduces the paperwork & time required to process the loans and offers customer satisfaction without redundancy.

The loan origination and servicing segment to dominate by 2031-

By application, the loan origination and servicing segment accounted for nearly two-thirds of the global loan management software market share in 2021. This is due to capabilities of loan origination & servicing in loan management software in automating the underwriting process with the help of custom loan approval rules and risk analysis algorithms. This reduces the need for manual calculation and accelerates decision-making at the credit approval stage. However, the collateral management segment would display the fastest CAGR of 20.2% throughout the forecast period. Due to the fact that the software is built in such a secured way, it ensures security to personal and financial data also reduce credit risk associated with any unsecured financial transactions between them.

North America garnered the major share in 2021-

By region, North America garnered the highest share in 2021, holding nearly one-third of the global loan management software market revenue in 2021. In the U.S. most of the lending companies are adopting digital services to offer loans digitally and with the help of software to the customers. Moreover, the loan management software is increasingly used by companies to serve their customers. In addition, personal loans and home loans are increasing in the U.S. for which customers demand a robust loan settlement procedure. However, the Asia-Pacific region would portray the fastest CAGR of 21.2% during the forecast period. Developing countries in Asia Pacific are more inclined toward obtaining loans for home finance and the demand for loan management software market has increased in recent years. Mortgage loan growth in countries such as China, India, and South Korea has raised the growth in demand for convenient lending process.

If you have any special requirements, please let us know: https://www.alliedmarketresearch.com/request-for-customization/8550

Leading Market Players-

- AllCloud

- Aryza

- Cyrus

- Finastra

- Finflux

- Infinity Enterprise Lending Systems

- LoanPro

- Nelito Systems Pvt. Ltd.

- Nortridge Software, LLC.

- TurnKey Lender

The report analyzes these key players in the global loan management software market. These players have adopted various strategies such as expansion, new product launches, partnerships, and others to increase their market penetration and strengthen their position in the industry. The report is helpful in determining the business performance, operating segments, developments, and product portfolios of every market player.

More Reports:

Foreign Exchange Services Market :

https://www.alliedmarketresearch.com/foreign-exchange-services-market-A07394

Accounts Payable Automation Market :

https://www.alliedmarketresearch.com/accounts-payable-automation-market-A53548

RPA in Insurance Market :

https://www.alliedmarketresearch.com/rpa-in-insurance-market-A53549

Cardless ATM Market :

https://www.alliedmarketresearch.com/cardless-atm-market-A12958

Surety Market :

https://www.alliedmarketresearch.com/surety-market-A31385

Banking CRM Software Market :

https://www.alliedmarketresearch.com/banking-crm-software-market-A07431

Pension Administration Software Market :

https://www.alliedmarketresearch.com/pension-administration-software-market-A47386

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com

Follow Us on | Facebook | LinkedIn | YouTube |