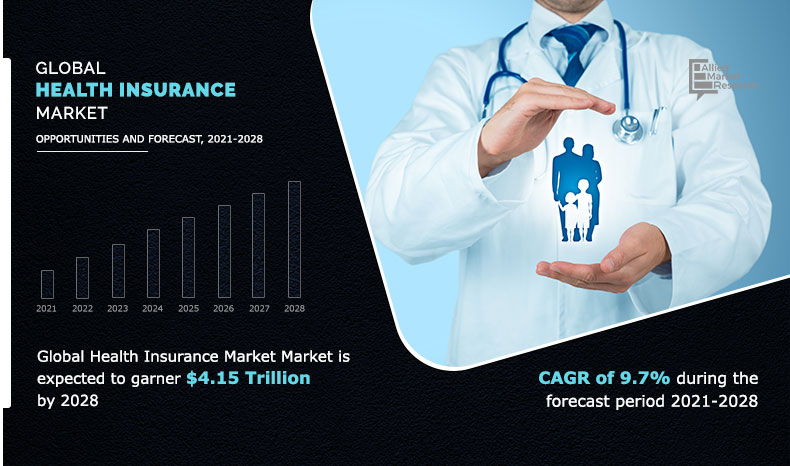

The global health insurance market generated $3,153 billion in 2018, and is estimated to reach $4,475 billion by 2026, growing at a CAGR of 4.4% from 2019 to 2026. The research offers a detailed analysis of changing market trends, top investment pockets, major segments, and the competitive landscape.

Surge in healthcare expenses, provisions related to healthcare insurance for public & private sectors, and increase in chronic diseases propel the growth of the global health insurance market. However, stringent regulations, huge time required for claim reimbursement, and lack of healthcare insurance awareness in rural regions restrain the market growth. On the other hand, innovations related to healthcare insurance products would offer lucrative opportunities in coming years.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/4338

Based on provider, the public service providers segment accounted for the highest share in 2018, contributing for more than half of the total market, due to lesser administrative costs offered in comparison to private health insurance providers. However, the private service providers segment is expected to grow at the fastest CAGR of 4.5% from 2019 to 2026, owing to private providers offering quick referral to consultants, availability of advanced treatment options, and flexible treatment time provided in private hospitals.

Based on insurance type, the medical insurance segment held the major share of the market in 2018, accounting for more than two-fifths of the global health insurance market. This is due to high costs incurred to expensive surgeries and rise in a number of road accidents. On the other hand, the income protection segment is expected to register the highest CAGR of 4.9% during the forecast period. This is due to provisions related to income protection insurance carried out in developed countries.

Based on region, North America accounted for the highest share in 2018, holding nearly one-third of the total market, owing to increase in adoption of private insurance and rise in population going through chronic illness. However, Asia-Pacific is expected to witness the highest CAGR of 4.9% from 2019 to 2026, owing to rise in awareness about benefits of healthcare insurance.

Enquire For Discount: https://www.alliedmarketresearch.com/purchase-enquiry/4338

Industry Money Makers:

- Allianz Group

- AIA Group Limited

- Assicurazioni Generali S.p.A.

- AXA Equitable Life Insurance Company

- Anthem, Inc.

- Munich Re

- China Life Insurance Company Limited

- State Farm Group

- Ping An Insurance (Group) Company of China, Ltd.

- Zurich Insurance Group.

By DISTRIBUTION CHANNEL

- DIRECT SALES

- BROKERS/AGENTS

- BANKS

- Others

By Insurance Type

- Disease Insurance

- Medical Insurance

By Coverage

- Preferred Provider Organizations (Ppos)

- Point Of Service (Pos)

- Health Maintenance Organizations (Hmos)

- Exclusive Provider Organizations (Epos)

By End User Type

- Group

- Individuals

By Age Group

- Senior Citizens

- Adult

- Minors

By Region

- North America (U.S., Canada)

- Europe (Germany, France, Spain, Switzerland, Netherlands, Rest of Europe)

- ASIA-PACIFIC (China, India, Japan, South Korea, Rest of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Related Reports:

B2B Payments Market https://www.alliedmarketresearch.com/b2b-payments-market-A08183

P2P Payment Market https://www.alliedmarketresearch.com/P2P-payment-market

Trade Finance Market https://www.alliedmarketresearch.com/trade-finance-market

Blockchain Government Market https://www.alliedmarketresearch.com/blockchain-government-market-A108804

Augmented Analytics in BFSI Market https://www.alliedmarketresearch.com/augmented-analytics-in-bfsi-market-A11748

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.