The main purpose of digital banking platform is to ensure continuous end to end processing of banking operations that are initiated by the client, ensuring maximum utility, in terms of availability, use, and cost. In addition, the growth of digital lending platform market can be attributed to continuous rise in the digital lending landscape among both developed and developing economies. Furthermore, surge in number of internet users and growths in shift from traditional banking to online banking are the major factors driving the growth of the digital banking platform market.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/5539

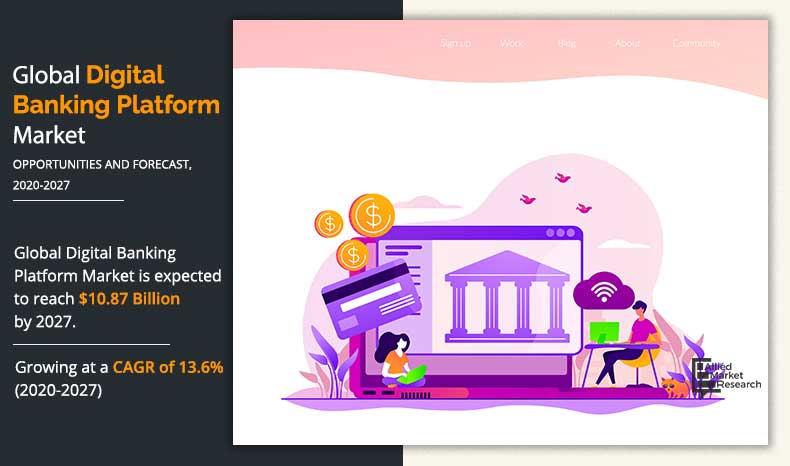

The global digital banking platform market size was valued at $3.95 billion in 2019 and is projected to reach $10.87 billion by 2027, growing at a CAGR of 13.6% from 2020 to 2027.

The main purpose of digital banking platform is to ensure continuous end to end processing of banking operations that are initiated by the client, ensuring maximum utility, in terms of availability, use, and cost. In addition, the growth of digital lending platform market can be attributed to continuous rise in the digital lending landscape among both developed and developing economies. Furthermore, surge in number of internet users and growths in shift from traditional banking to online banking are the major factors driving the growth of the digital banking platform market.

In addition, increase in adoption of cloud-based platform to obtain higher scalability fuels the growth of the market. However, security and compliance issues in digital lending platform hampers the growth of the digital banking platform market. Furthermore, growth in usage of machine learning and artificial intelligence in digital banking platform and increase in innovative banking services and rise in corporate investors is expected to provide lucrative opportunity for the market.

Buy Now and Get Discount: https://www.alliedmarketresearch.com/checkout-final/657c094448407f8735d32688619590b9

By mode, the global digital banking platform market led by the online banking segment in 2019 and is projected to maintain its dominance during the forecast period. The online banking requires high level of process automation, web-based services, and Application Programming Interfaces (APIs), and facilitates real-time integration with a bank’s multiple host systems which boost the growth of the digital banking platform market. However, the mobile banking segment is expected to grow at the highest rate during the forecast period, owing to rising mobile user and surge in penetration of internet across the globe.

Region wise, the digital banking platform market was dominated by North America in 2019 and is expected to retain its position during the forecast period. The major factor that drives the growth of the market in this region includes early adoption of advanced technology among the end user and surge in adoption of digital banking platform among the end users. However, Asia-Pacific is also expected to witness significant growth rate during the forecast period, owing to the rising adoption of online and mobile banking among the emerging countries of Asia-Pacific such as China, India and Singapore.

Though COVID-19 crisis continues to disrupt many industries, it has opened opportunities for high adoption of digital transformation approaches among which digital banking platform services have gained high importance and adoption. When state and country-wide lockdowns initiated at the beginning of 2020, both employee and customer engagement & experience became major factors to drive the global digital banking platform market. Furthermore, various key players of the market are introducing new digital banking strategies to enhance the customer experience and to improve their market share in the pandemic situation.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/5539

Key Findings Of The Study

By component, the solution segment accounted for the highest digital banking platform market share in 2019.

By type, retail banking segment generated the highest revenue in 2019.

By banking mode, the mobile banking segment is anticipated to exhibit substantial growth during the forecast period.

The key players profiled in the digital banking platform market analysis are Appway, COR Financial Solution Ltd., Edgeverve, FIS Global, Fiserv, Inc, nCino, Oracle Corporation, SAP SE, Temenos, and Vsoft Corporation. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

Trending Reports:

Hybrid Cloud in BFSI Market: https://www.alliedmarketresearch.com/hybrid-cloud-in-bfsi-market-A14267

Letter of Credit Confirmation Market: https://www.alliedmarketresearch.com/letter-of-credit-confirmation-market-A06312

Financial Planning Software Market: https://www.alliedmarketresearch.com/financial-planning-software-market-A16422

Equity Management Software Market: https://www.alliedmarketresearch.com/equity-management-software-market-A16643

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.