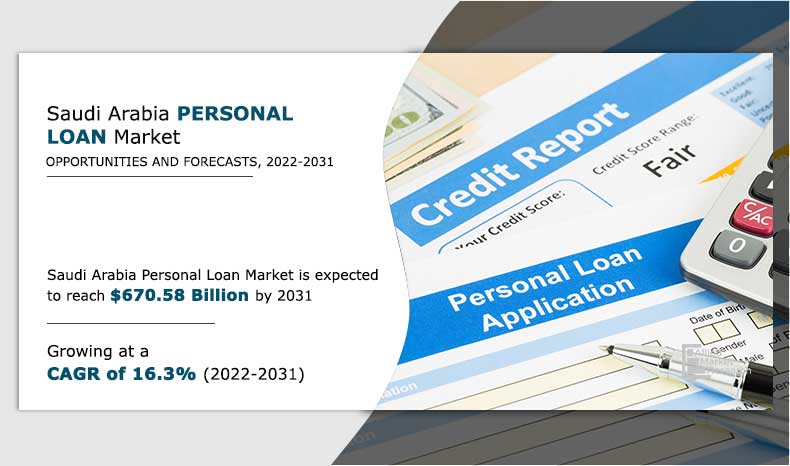

According to a recent report published by Allied Market Research, the personal loans market in Saudi Arabia experienced significant growth, generating $146.54 billion in 2021. The market is expected to continue expanding and is projected to reach $670.58 billion by 2031, with a compound annual growth rate (CAGR) of 16.3% from 2022 to 2031.

To Get a Sample Copy of this Strategic Report (Use Corporate Mail ID for Top Priority) @ https://www.alliedmarketresearch.com/request-sample/74882

The report provides a comprehensive analysis of the evolving market trends, key segments, lucrative investment opportunities, value chains, regional landscape, and competitive scenario. It serves as a valuable source of information for established market players, new entrants, investors, and stakeholders, enabling them to develop strategies and strengthen their market position in the future.

Key Market Players

- Abdul Latif Jameel United Finance Company

- Al Rajhi Bank

- Alinma Bank

- Arab National Bank

- Bank Albilad

- Banque Saudi Fransi

- Emirates NBD Bank

- Emirates NBD Bank

- Emkan Finance Company

- Nayifat

- Quara Holding

- Riyad Bank

- SAAB

- Tamam Finance

- SNB

The Saudi Arabia personal loans market is experiencing significant growth due to several key factors. One of the drivers is the increasing need for personal loans to consolidate debt, as individuals seek financial solutions to manage their financial obligations more effectively. Additionally, there is a growing demand for personal loans offering lower interest rates, as borrowers look for more affordable borrowing options.

The adoption of advanced technologies such as AI, blockchain, and machine learning by personal loans firms in the region is also contributing to market growth. These technologies enhance efficiency, streamline processes, and provide personalized loan offerings, improving the overall customer experience.

Furthermore, the high demand for residential houses from expatriates entering the country is fueling the expansion of the personal loans market. As more expatriates relocate to Saudi Arabia, there is a need for financing options to support their housing requirements.

Inquire Before Buying : https://www.alliedmarketresearch.com/purchase-enquiry/74882

Moreover, the government’s initiatives to strengthen the financial system are playing a significant role in the market’s growth. These initiatives aim to enhance the regulatory framework, promote financial inclusion, and foster a favorable business environment, encouraging more lending activities in the personal loans sector.

Overall, these factors collectively contribute to the robust growth of the Saudi Arabia personal loans market, providing opportunities for market players to capitalize on the rising demand and evolving customer needs.

The report offers a detailed segmentation of the Saudi Arabia personal loans market based on type, marital status, consumer age, and end user, and region. The report provides an analysis of each segment and sub-segment with the help of tables and figures. This analysis helps market players, investors, and new entrants in determining the sub-segments to be tapped on to achieve growth in the coming years.

Based on type, the P2P marketplace segment held the largest share in 2021, accounting for more than two-thirds of the Saudi Arabia personal loans market and would dominate the market in terms of revenue through 2031. The balance sheet segment is estimated to witness the fastest CAGR of 18.2% during the forecast period.

In terms of marital status, the single segment captured the largest market share of nearly three-fifths of the Saudi Arabia personal loans market in 2021 and is expected to lead the trail during the forecast period. However, the others segment is likely to achieve the fastest CAGR of 19.2% through 2031. The report also studies the married segment.

Based on consumer age, the 30-50 segment held the largest share in 2021, accounting for nearly half of the Saudi Arabia personal loans market and would dominate the market in terms of revenue through 2031. The less than 30 segment, however, is estimated to witness the fastest CAGR of 18.2% during the forecast period. The report also studies the more than 50 segment.

Based on end user, the salaried segment was the largest in 2021, accounting for nearly four-fifths of the Saudi Arabia personal loans market and is likely to maintain its dominance during the forecast period. However, the business segment in is expected to manifest the highest CAGR of 19.5% from 2022 to 2031. The report also studies the segments.

Key Benefits for Stakeholders

- The study provides an in-depth analysis of the Saudi Arabia personal loan market forecast along with current & future trends to explain the imminent investment pockets.

- Information about key drivers, restraints, & opportunities and their impact analysis on Saudi Arabia personal loan market trend is provided in the report.

- The Porter’s five forces analysis illustrates the potency of the buyers and suppliers operating in the industry.

- The Saudi Arabia personal loan market analysis from 2022 to 2031 is provided to determine the market potential.

Request Customization : https://www.alliedmarketresearch.com/request-for-customization/74882

Saudi Arabia Personal Loan Market Report Highlights:

Aspects Details

By Type

- P2P Marketplace

- Balance Sheet

By Marital Status

- Married

- Single

- Others

By Consumer Age

- Less than 30

- 30-50

- More than 50

By End-User

- Salaried

- Male

- Female

- Others

- Business

More Reports:

Fintech Cloud Market : https://www.alliedmarketresearch.com/fintech-cloud-market-A31616

WealthTech Solutions Market : https://www.alliedmarketresearch.com/wealthtech-solutions-market-A31614

Currency Management Market : https://www.alliedmarketresearch.com/currency-management-market-A31435

Payroll Outsourcing Market : https://www.alliedmarketresearch.com/payroll-outsourcing-market-A31433

Syndicated Loans Market : https://www.alliedmarketresearch.com/syndicated-loans-market-A31434

Gadget Insurance Market : https://www.alliedmarketresearch.com/gadget-insurance-market-A11629

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com