Commercial trucks are broken down into the broad categories of light duty, medium duty, and heavy duty. The concept of heavy duty truck is typically attributed to the motor vehicle that are designed to transport cargo, carry specialized payloads, or perform other utilitarian work. Although, heavy-duty trucks are heavier than medium duty trucks. Their weight ranges between 26,001 lbs to over 33,000 lbs (11,794 kg to over 14,969 kg). Thus, heavy duty trucks are gaining traction owing to their high carrying capacity and strong suspension system useful in transportation activities. Majority of construction companies prefer heavy-duty trucks for carrying debris and materials at any terrain for long distances.

𝗗𝗼𝘄𝗻𝗹𝗼𝗮𝗱 𝗙𝗿𝗲𝗲 𝗦𝗮𝗺𝗽𝗹𝗲 – https://www.alliedmarketresearch.com/request-sample/10458

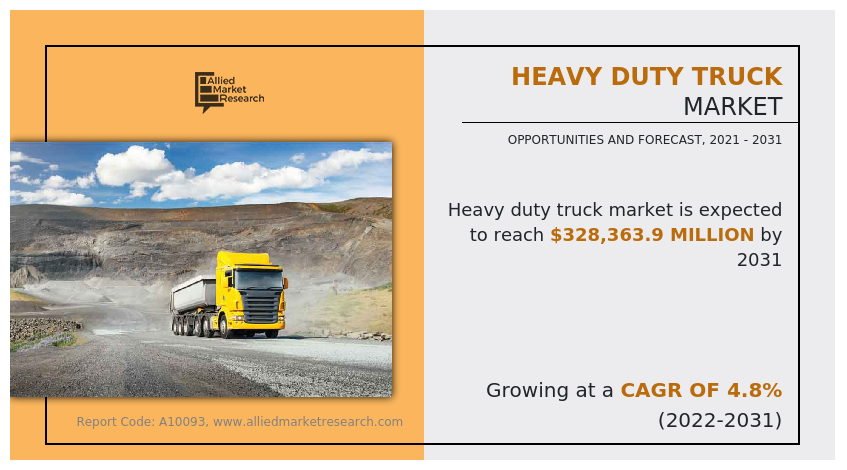

According to a new report published by Allied Market Research, titled, “Heavy Duty Truck Market,” The heavy duty truck market was valued at $209,973.7 million in 2021, and is estimated to reach $328,363.9 million by 2031, growing at a CAGR of 4.8% from 2022 to 2031.

These trucks have advanced features, lightweight structure frame, and wider availability, increasing their market representation worldwide. Moreover, heavy-duty trucks comprise a trailer or a goods carrying space that provide easy and safe transportation. Hence, heavy-duty trucks are employed in diverse industries including logistics, construction, and Dump trucks. These trucks save time for the transportation of the goods and materials.

For instance, in September 2021, Tata Motors announced its plans to invest over $1 billion, or an amount exceeding Rs 7,500 crore over the next 4-5 years to recreate its road-map for the commercial vehicle business, a major part of which comprises electric vehicles, which in turn propels the electric segment of heavy duty truck market.

In addition, the global heavy duty truck market has witnessed significant growth in recent years, owing to the growing need of consistent material supply to the power industries and debris removal to speed up the mining activities is accelerating the sale of sleeper cab class 8 heavy-duty trucks. Industry participants, such as Hyundai, Ashok Leyland, and Kenworth, are developing class 8 sleeper trucks for heavy operation across all sectors. Furthermore, the companies operating in the heavy duty truck market have adopted partnerships, investments, and product launches to increase their market share and expand their geographical presence.

For instance, in April 2020, Volvo Group and Daimler truck AG signed a non-binding agreement to form a new joint venture with a focus on the development of advanced fuel cell systems for heavy-duty commercial vehicle applications in Europe.

𝗜𝗻𝘁𝗲𝗿𝗲𝘀𝘁𝗲𝗱 𝘁𝗼 𝗣𝗿𝗼𝗰𝘂𝗿𝗲 𝘁𝗵𝗲 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗥𝗲𝗽𝗼𝗿𝘁? 𝗜𝗻𝗾𝘂𝗶𝗿𝗲 𝗕𝗲𝗳𝗼𝗿𝗲 𝗕𝘂𝘆𝗶𝗻𝗴 – https://www.alliedmarketresearch.com/purchase-enquiry/10458

Rising demand for the commodity along with increased construction and infrastructure development are the main factors driving the demand for heavy duty trucks. Presently, trucks built are more reliable, more efficient, more fuel efficient and have higher payloads than trucks built before. However, technological advances have improved fuel efficiency, and new technology allows trucks to carry more weight than vehicles of the same power. As a result, the world faces a major problem of carrying heavy loads, which may lead to a decline in the use of more vehicles. Heavy trucks are also used as garbage and garbage collectors.

Furthermore, governments across the globe are taking initiatives to educate people about waste management and recycling. This, in turn, is expected to drive the global market of waste and subsequently, of heavy-duty trucks. India is projected to be a major market for waste or heavy-duty trucks during the forecast period, as government initiatives, such as smart-city and Swachh-Bharat, to create a healthy and clean environment are estimated to offer significant opportunity to the waste or heavy-duty trucks market.

COVID-19 Impact Analysis:

The pandemic impacted the source of earnings of various trucks drivers, owing to which the number of loan defaulters has increased considerably. For instance, according to Trucking HR Canada’s Labour Market Snapshot, during the first two quarters of 2020, 49,000 truck drivers lost their jobs. However, from June to August, the industry added 43,500 new drivers. Thus, the unemployment rate amongst drivers across these region is decreased from a high of 12% in June 2020, to 6.3% in August 2020, which was less than the overall national unemployment rate. However, as COVID-19 cases declined and things continued to return to normal, truckers were also getting backed up on their feet.

𝗣𝗿𝗼𝗰𝘂𝗿𝗲 𝗥𝗲𝘀𝗲𝗮𝗿𝗰𝗵 𝗥𝗲𝗽𝗼𝗿𝘁 𝗼𝗻 @ https://www.alliedmarketresearch.com/heavy-duty-truck-market/purchase-options