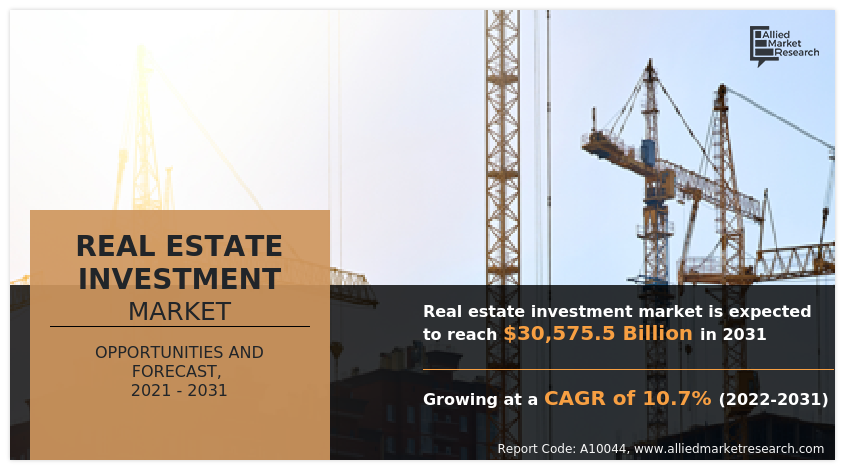

According to the report published by Allied Market Research, the global real estate investment market generated $11,444.7 billion in 2021, and is projected to reach $30,575.5 billion by 2031, growing at a CAGR of 10.7% from 2022 to 2031. The report offers a detailed analysis of the top winning strategies, evolving market trends, market size and estimations, value chain, key investment pockets, drivers & opportunities, competitive landscape and regional landscape. The report is a useful source of information for new entrants, shareholders, frontrunners and shareholders in introducing necessary strategies for the future and taking essential steps to significantly strengthen and heighten their position in the market.

Get PDF Sample: https://www.alliedmarketresearch.com/request-sample/10409

The report offers detailed segmentation of the global real estate investment market based on property type, purpose, distribution channel, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on fastest growing segments and highest revenue generation that is mentioned in the report.

Based on distribution channel, the public RIET segment held the largest market share in 2021, holding half of the global real estate investment market share. The private RIET segment, on the other hand, is expected to maintain its leadership status during the forecast period. In addition, the same segment is expected to cite the fastest CAGR of 13.3% during the forecast period.

Based on purpose, the sales segment held the dominating market share in 2021, holding nearly three-fifths of the global real estate investment market share, and is expected to maintain its leadership status during the forecast period. The rental segment, on the other hand, is expected to cite the fastest CAGR of 12.3% during the forecast period.

Based on region, the market across North America held the largest share of the global real estate investment in 2021, holding nearly two-fifths of the global market share. The Asia-Pacific region, on the other hand, is expected to maintain its leadership status during the forecast period. In addition, the same region is expected to cite the fastest CAGR of 14.1% during the forecast period.

The key players analyzed in the global real estate investment market report include ATC IP LLC, AVALONBAY, INC., Ayala Land, Inc., Brookfield Asset Management Inc., Gecina Real Estate Company, Link Asset Management Limited, Prologis, Inc., SEGRO plc, Simon Property Group, L.P., CBRE Group, Inc., Jones Lang LaSalle IP, Inc., New World Development Company Limited, Colliers International, Newmark Group Inc., Welltower Inc., CADRE Financial Technology Company, and Roofstock, Inc.

For Purchase Inquiry: https://www.alliedmarketresearch.com/purchase-enquiry/10409

The report analyzes these key players in the global real estate investment market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance and operating segments by prominent players in the market.

KEY BENEFITS FOR STAKEHOLDERS

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the real estate investment market forecast from 2022 to 2031 to identify prevailing real estate investment market opportunity.

- In addition to the market research, important drivers, restraints, and opportunities are covered as well.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the real estate investment market segmentation assists in determining the prevailing market opportunities.

- According to their contribution to global market revenue, the major countries in each region are mapped.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global real estate investment market trends, key players, market segments, application areas, and market growth strategies.

If you have any special requirements, please let us know: https://www.alliedmarketresearch.com/request-for-customization/10409

Key Market Segments

Distribution Channel

- Public REIT

- Private REIT

- Private Real Estate Investment

Property Type

- Land Investment

- Residential Investment

- Commercial Investment

- Commercial Investment

- Office Space

- Retail Space

- Leisure Space

- Others

- Commercial Investment

- Industrial Investment

- Industrial Investment

- Manufacturing Plants

- Warehouse/Distribution

- Others

- Industrial Investment

Purpose

- Sales

- Rental

By Region

- North America (U.S., Canada)

- Europe (UK, Germany, France, Italy, Spain, Netherlands, Switzerland, Rest Of Europe)

- Asia-Pacific (China, Japan, India, Australia, South Korea, Hong Kong, Rest Of Asia-Pacific)

- LAMEA (Latin America, Middle East, Africa)

Top More Reports:

Management Consulting Services Market :

https://www.alliedmarketresearch.com/management-consulting-services-market-A19875

Medical Professional Liability Insurance Market :

https://www.alliedmarketresearch.com/medical-professional-liability-insurance-market-A30183

Real-Time Payments Market :

https://www.alliedmarketresearch.com/real-time-payments-market-A19437

Saudi Arabia Microfinance Market :

https://www.alliedmarketresearch.com/saudi-arabia-microfinance-market-A31026

Horse Insurance Market :

https://www.alliedmarketresearch.com/horse-insurance-market-A12004

Open Banking Market :

https://www.alliedmarketresearch.com/open-banking-market

Equity Management Software Market :

https://www.alliedmarketresearch.com/equity-management-software-market-A16643

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com