Allied Market Research published a report on the commercial auto insurance market. The research provides a clear picture of the market’s current needs and future prospects. The research study gives a 360-degree overview of the overall market environment by supplying details on the commercial auto insurance market size and share analysis, market dynamics, segmental & regional analysis, top investment pockets, competition landscape, and other factors for the projected forecast period.

Download Research Sample: https://www.alliedmarketresearch.com/request-sample/14525

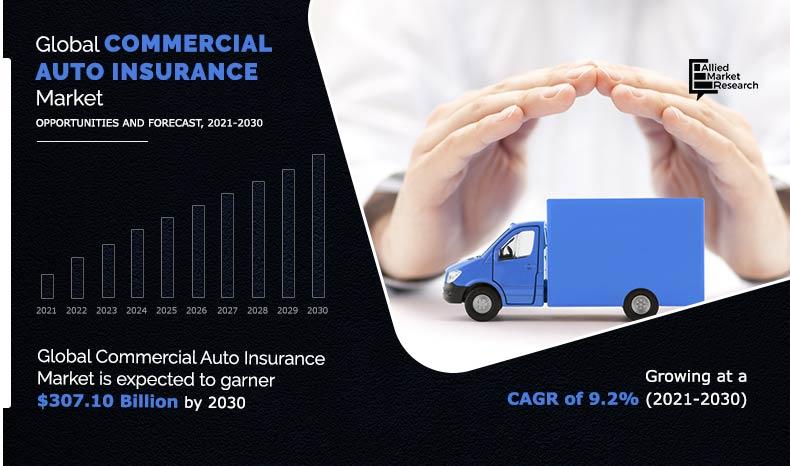

According to the report published by Allied Market Research, the global commercial auto insurance market generated $128.43 billion in 2020, and is projected to reach $307.10 billion by 2030, witnessing a CAGR of 9.2% from 2021 to 2030. The report provides a detailed analysis of changing market dynamics, top segments, value chain, key investment pockets, regional scenario, and competitive landscape.

Increase in number of road accidents, stringent government guidelines, and rise in usage of commercial vehicles drive the growth of the global commercial auto insurance market. However, expensive commercial auto insurance policies restrain the market to some extent. On the other hand, implementation of technology in the field of commercial auto insurance presents new opportunities in the upcoming years.

The report offers detailed segmentation of the global commercial auto insurance market based on vehicle type, vehicle age, coverage type, distribution channel, and region.

Based on vehicle type, the light goods vehicle segment held the highest market share in 2020, holding more than three-fifths of the total market share, and is expected to continue its leadership status during the forecast period. However, the heavy goods vehicle segment is estimated to register the highest CAGR of 11.0% from 2021 to 2030.

Get Exclusive Discount: https://www.alliedmarketresearch.com/purchase-enquiry/14525

Based on coverage age, the third party liability coverage segment held the largest market share in 2020, holding nearly three-fifths of the total market share, and is expected to continue its leadership status during the forecast period. Moreover, the collision/comprehensive/optional coverage segment is projected to register the highest CAGR of 10.5% from 2021 to 2030.

Based on region, North America contributed to the highest share in terms of revenue in 2020, holding nearly two-fifths of the global market share, and is estimated to continue its dominant share by 2030. Moreover, Asia-Pacific is projected to manifest the fastest CAGR of 10.9% during the forecast period.

Leading players of the global commercial auto insurance market analyzed in the research include Allianz, American International Group Inc., Aon plc, Aviva, AXA, Berkshire Hathaway Inc., Chubb, Liberty Mutual Insurance Company, Willis Towers Watson, and Zurich.

Frequently Asked Questions (FAQ’s):

Q.1 Can I customize the report’s scope and make it my own to meet my needs?

Answer- Yes. Multidimensional, deep-level, and high-quality requirements that are particularly suited to our customers’ needs can help them accurately grasp market opportunities, face market challenges with ease, properly formulate market strategies, and act quickly, giving them an advantage in the market competition.

Share Your Requirements & Get Customized Reports @ https://www.alliedmarketresearch.com/request-for-customization/14525

Q.2 What are the key products or services offered in the market, and how do they compare to each other?

Q.3 What are the regulations and legal aspects affecting the market?

Q.4 Who are the main players in the market, and what is their market share?

Q.5 How do companies set their prices in the market, and what is the competitive landscape like?

Q.6 What are the potential future prospects and growth opportunities in the market?

Q.7 What are the current trends and factors driving the market? What challenges and opportunities exist?

Q.8 How much revenue, sales volume, or number of users/customers does the market have?

Q.9 How do companies promote and market their products/services in the market?

Q.10 What are the preferences and behaviors of customers in the market?

Q.11 What are the different segments of the market, and how are they expected to grow?

Our Top Trending Reports:

| Open Banking Market : https://www.alliedmarketresearch.com/open-banking-market |

| Factoring Services Market : https://www.alliedmarketresearch.com/factoring-services-market-A17187 |

| Virtual Cards Market: https://www.alliedmarketresearch.com/virtual-cards-market-A17176 |

| Mortgage Lending Market : https://www.alliedmarketresearch.com/mortgage-lending-market-A17282 |

| Accounting & Budgeting Software Market : https://www.alliedmarketresearch.com/accounting-&-budgeting-software-market-A17180 |

| Reinsurance Market : https://www.alliedmarketresearch.com/reinsurance-market-A06288 |

| Management Consulting Services Market : https://www.alliedmarketresearch.com/management-consulting-services-market-A19875 |

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com