Real estate loan is a type of loan provided by banks or other financial institutions that help borrowers purchase home, land, office, or any other type of real estate property. In addition, real estate loans are rising in popularity among individuals and businesses for purchasing real estate properties by doing small down payments, which drives growth of the real estate loan market. Furthermore, key factors that drive the market include growth in need to streamline real estate lending services and increase in need for money among businesses and individuals to purchase real estate. In addition, flexible period to repay the loan amount positively impacts growth of the market. However, factors such as enforcement of strong rules by banks and financial institutions for providing loan services is expected to hamper the real estate loan market growth. On the contrary, rise in prices of real estate properties in China, Japan, and India and penetration of metropolitan cities across the globe are expected to offer remunerative opportunities for expansion of the market during the forecast period.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/10413

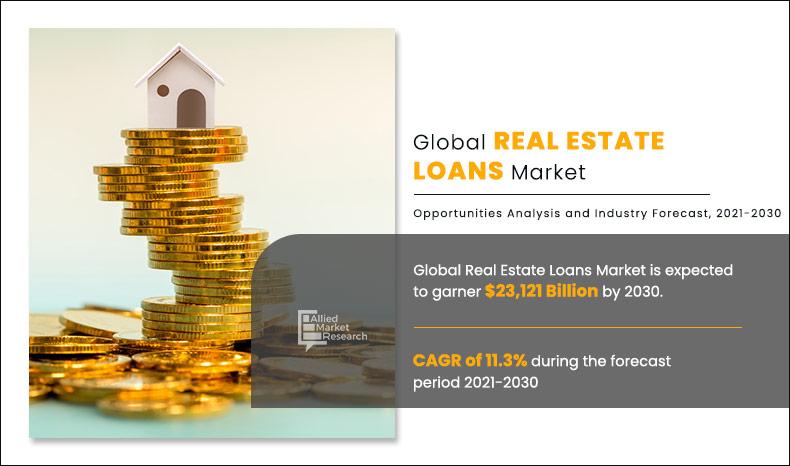

Real Estate Loan Market by Providers, End-Users and Property Type: Global Opportunity Analysis and Industry Forecast, 2021–2030,” the global real estate loan market size was valued at $7,968 billion in 2020, and is projected to reach $23,121 billion by 2030, growing at a CAGR of 11.3% from 2021 to 2030.

Region wise, the real estate loan market was dominated by North America, and is expected to retain its position during the forecast period. This is attributed to increase in demand for real estate among business and individuals. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to rising awareness about the benefit of real estate loan among the general public and growth in number of personal real estate loan.

Purchase Full Report: https://www.alliedmarketresearch.com/checkout-final/2e3666f4fa36c7dc29dc6a6c944f14e4

COVID-19 Impact Analysis

The outbreak of COVID-19 is anticipated to have a negatively impact on growth of real estate loan market. This is attributed to implementation of lockdown by governments in majority of the countries and rise in adoption of work-from-home culture across all industries. Furthermore, real estate market was heavily restricted owing to increasing travel restrictions, which in turn negatively impacted the growth of real estate loan market. In addition, with rising uncertainty with respect to income and employment influenced consumers to postpone new car purchased or leased. Moreover, shortage in supply of raw materials and logistics has severely disrupted the supply chain of automotive and delayed new real estate launches in the market. Therefore, owing to these factors, the buying behavior of consumers has changed, which has forced them to postpone their buying decision during the pandemic situation. Moreover, social distancing and work-from-home has completely reduced the need of mobility, therefore, has an adverse effect on the real estate loan market.

Key Findings of The Study

By provider, the banks segment accounted for the largest real estate loan market share in 2020.

Region wise, North America generated highest revenue in 2020.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/10413

The key players profiled in the real estate loan market analysis are Bank of America Corporation., JPMorgan Chase & Co., Lendio, Liberty SBF, Northeast Bank, Santander Bank, N. A., SmartBiz, The PNC Financial Services Group, Inc., U.S. Bank, and Wells Fargo. These players have adopted various strategies to increase their market penetration and strengthen their position in the real estate loan industry.

Trending Reports:

Personal Loans Market: https://www.alliedmarketresearch.com/personal-loans-market-A07580

Payday Loans Market: https://www.alliedmarketresearch.com/payday-loans-market-A10012

Loan Compliance Management Software Market: https://www.alliedmarketresearch.com/loan-compliance-management-software-market-A08299

Farming and Agriculture Finance Market: https://www.alliedmarketresearch.com/farming-and-agriculture-finance-market-A14729

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.