Surety insurance is a popular term for surety bonds. A surety bond is a sum of money put up as a guarantee of good faith by one party. Frequently, it involves large sums of money and consumers rely on bonding agencies to put up the money on their behalf. If the bond is forfeited, the person or business owes the bonding agency the full amount of the bond. Furthermore, credit surety indemnifies the policyholder’s loss. As a result, this is expected to boost the credit & surety insurance market growth.

Download Sample Report: https://www.alliedmarketresearch.com/request-toc-and-sample/13326

The Credit & Surety Insurance Market share is segmented on the basis of type, end user, and region. Based on type, the market is bifurcated into contract surety bond, commercial surety bond, court surety bond, and fidelity surety bond. By end user, it is categorized into individual and enterprises. Based on region, the market is analyzed across North America (the U.S. and Canada), Europe (Germany, the UK, France, and Rest of Europe), Asia-Pacific (China, Japan, India, and Rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

Key players operating in the Credit & Surety Insurance Market include Accion International, BlueVine, Inc, Fundera, Inc, Funding Circle, Kabbage, Kiva, Lendio, LENDR, OnDeck, and StreetShares, Inc. These players adopt collaboration, partnership, and agreement as their key developmental strategies to increase revenue of the Credit & Surety Insurance industry and develop new products for enhancing product portfolio.

COVID-19 Scenario Analysis

The financial industry across the world was witnessing drastic growth prior to the emergence of COVID-19 in late 2019. The outbreak of COVID-19 has led the construction industry players to temporarily call off their current projects. Due to the unpredictable impact of COVID-19 and uncertainty in the economic conditions of both developed and developing countries, the demand for credit & surety insurance among enterprises has increased in the market.

The credit surety industry was affected by the COVID-19 pandemic, but insurers raised premiums due to an increase in the number of claims during the pandemic to maintain the company’s profitability. A high premium is expected to have an impact on the revenues of businesses shortly.

Top Impacting Factors: Market Scenario Analysis, Trends, Drivers, and Impact Analysis

Protection from potential losses, security provision, and increased demand for credit safety are driving the growth of the market. However, high premium and slow economy growth during COVID-19 pandemic are expected to hamper the growth of the market. Contrarily, rise in need of innovative insurance solutions to offer better service to customer and digital credit insurance can be seen as an opportunity for the market.

Buy This Report: https://www.alliedmarketresearch.com/checkout-final/fad3f73530abbe70b2451cf33ffe0f9a

The credit & surety insurance market trends are as follows:

Provision of security and increased demand for credit safety

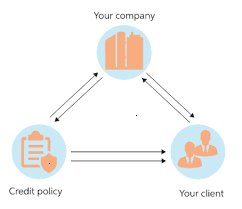

Trade credit insurance can help businesses avoid bankruptcy and manage their credit from borrowers. Trade credit insurance is distributed in addition to these other lines of insurance. For instance, if a company ensures its receivables, it can generate assets from those banks and investors in the market. Banks prefer secured receivables and discount the bills against them, which can become a useful additional source of cash flow for companies.

Increased demand for innovative insurance solutions to provide better service to customers

In high-growth markets, there is an increased demand for innovative construction. The One Belt One Road Initiative in China is expected to provide opportunities for the growth of the surety market. The determined investment strategy aims to promote both Chinese and global economic growth. The initiative, a mega infrastructure project, aims to attract investment largely in the transportation sector and the energy sectors. That includes the construction of roads, bridges, railways, ports, power grids, and other large construction projects. In addition, credit insurance is expected to see an increase in project-related premium income as a fastest-growing insurance premium in the market. Moreover, the One Belt One Road initiative is expected to benefit the surety market. Therefore, rise in construction and growth in the money lending business are expected to foster the credit & surety insurance market growth in the upcoming years.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/13326

Key Benefits of the Report

This study presents analytical depiction of credit & surety insurance market along with the current trends and future estimations to determine the imminent investment pockets.

The report presents information related to key drivers, restraints, and opportunities along with detailed analysis of the market share.

The current market is quantitatively analyzed to highlight the credit & surety insurance market growth scenario.

Porter’s five forces analysis illustrates the potency of buyers & suppliers in the market.

The report provides a detailed market analysis depending on the present and future competitive intensity of the market.

Trending Reports:

Two wheeler Insurance Market: https://www.alliedmarketresearch.com/two-wheeler-insurance-market-A07582

Pet Insurance Market: https://www.alliedmarketresearch.com/pet-insurance-market

Hull & Machinery Insurance Market: https://www.alliedmarketresearch.com/hull-and-machinery-insurance-market-A12006

Direct Insurance Carriers Market: https://www.alliedmarketresearch.com/direct-insurance-carriers-market-A09991

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.