Payday loan is a type of short-term cash loans that is provided to borrowers with high interest rate without any collateral provided by the borrowers. In addition, as payday loans continue to attract new users, more market participants are becoming aware of the need for straightforward tools designed to manage payday loans for borrowers of all skill levels which is driving the growth of the market.

Download Sample Report: https://www.alliedmarketresearch.com/request-sample/10377

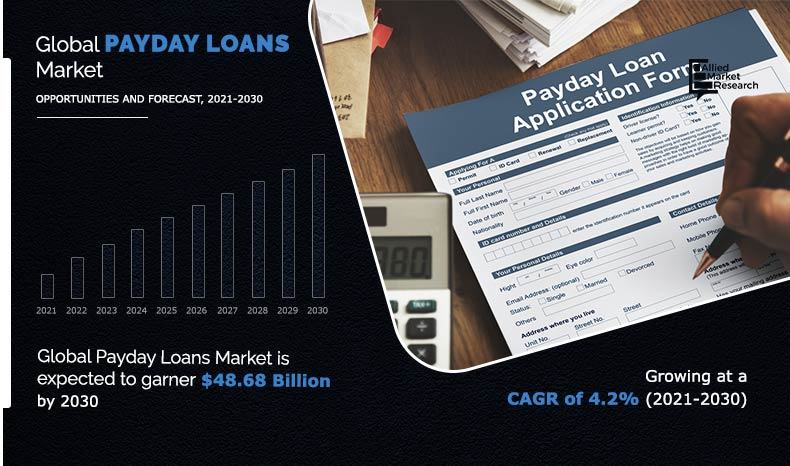

Payday Loans Market by Type, Marital Status and Customer Age: Global Opportunity Analysis and Industry Forecast, 2021-2030,” the global payday loans market size was valued at $32.48 billion in 2020, and is projected to reach $48.68 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030.

Moreover, payday loan providers are typically small credit merchants who provide loans to the borrowers from physical platform as well as through online platform. In addition, payday loans help people in emergency need of cash without the need of any proof, which is driving the market. Furthermore, the key factor that drives the market includes growing awareness about the payday loan among the youth population and fast loan approval with no restriction on usage.

In addition, presence of large number of payday lenders positively impacts the growth of the market. However, factors such high interest rates and negative impact of payday loans on credit score are expected to hamper the payday loans market growth. On the contrary, rise in adoption of advance technology among the payday lenders is expected to offer remunerative opportunities for the expansion of the market during the forecast period.

Buy This Report: https://www.alliedmarketresearch.com/checkout-final/a5b72c2e8bd30d069c1d6ca840412bf2

Depending on marital status, single is expected to hold the largest global payday loans market as individuals are rapidly using payday loans for full filling their daily necessities. However, married is expected to witness significant growth rate during the forecast period, owing to growing need to repay the loan amount among the married people as well as to pay unexpected debt and medical bill provides lucrative opportunity for the market.

Region wise, the global payday loans market was dominated by North America, and is expected to retain its position during the forecast period. This is attributed to increase in adoption of advance technologies such as cloud technology, big data, artificial intelligence, and machine learning for automating the payday loan solutions and providing online payday solutions with high privacy. However, Asia-Pacific is expected to witness significant growth rate during the forecast period, owing to rising payday loan awareness among the youth and growth in number of payday lenders in Asia-Pacific.

COVID-19 Impact Analysis

The outbreak of COVID-19 is anticipated to have a positive impact on the growth of the global payday loans market trends. With the rise of COVID-19 pandemic, millions of people have lost their jobs and pay day loans have experienced a significant boost due to growing government support and favorable government schemes for the workers. In addition, many payday lenders wanted to repeat the same that has been repeating for the past two recessions that occurred in 1923 and 1926, i.e. to target the low earners to boost the market.

Enquire Before Buying: https://www.alliedmarketresearch.com/purchase-enquiry/10377

However, due to several COVID-19 relief schemes many unemployed and low earners have been saved and are able to protect themselves from the temptation of payday loans. In addition, even with the ongoing schemes, many youngsters are taking payday loans to keep continuing with their living style before pandemic and job loss. Furthermore, according to a study of consumer spending, it was found that majority of the people in the U.S. have reduced their spending and are instead trying to resolve their old debts as soon as possible. This change in behavior is however negatively impacting the growth of the market.

Key Findings Of The Study

Depending on type, the storefront payday loans accounted for the largest global payday loans market share in 2020.

Region wise, North America accounted highest revenue in 2020.

Depending on marital status, the single generated the highest revenue in 2020.

The key players profiled in the global payday loans market analysis are Speedy Cash, Titlemax, CashNetUSA, Silver Cloud Financial, Inc., TMG Loan Processing, THL Direct, Lending Stream, Creditstar, Myjar, and Cashfloat. These players have adopted various strategies to increase their market penetration and strengthen their position in the payday loans industry.

Trending Reports:

Personal Loans Market: https://www.alliedmarketresearch.com/personal-loans-market-A07580

Trade Surveillance System Market: https://www.alliedmarketresearch.com/trade-surveillance-system-market-A11313

Capital Expenditure Market: https://www.alliedmarketresearch.com/capital-expenditure-market-A07601

Investment Banking Market: https://www.alliedmarketresearch.com/investment-banking-market-A06710

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.