Insurtech has been increasingly adopted by insurers as it improves the customer experience, simplifies policy management, and increases competition, which are some of the major Insurtech market trends

Request Sample Report: https://www.alliedmarketresearch.com/request-sample/12738

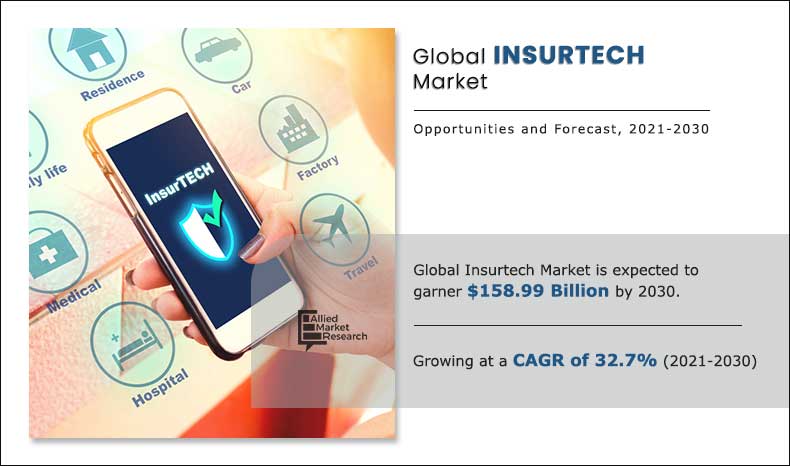

The global Insurtech market size was valued at $9.41 billion in 2020, and is projected to reach $158.99 billion by 2030, growing at a CAGR of 32.7% from 2021 to 2030.

Insurtech is the emergence of new technologies engages in transforming the insurance industry, reducing costs for consumers & insurance companies, and enhancing better customer experience. With an implementation of Insurtech, customers can research, compare policies, and make a purchase online without having to physically visit a local agent. Moreover, Insurtech companies have streamlined process of buying all types of insurance with easier & convenient options.

Factors such as rapid digitalization of business models and saturation of the insurance industry propel the global Insurtech market growth. In addition, incorporation of technologies in existing product lines among insurance companies and untapped potential of emerging economies are expected to provide lucrative opportunities for the Insurtech solution providers in the coming years.

Buy Now: https://www.alliedmarketresearch.com/checkout-final/2e8e42fbbafa7b5d92e1ad32910b81d7

On the basis of application, sales & marketing segment dominated the Insurtech market share in 2020 and is projected to maintain its dominance during the forecast period. This is attributed to the fact that Insurtech helps in customer acquisition, using upsell & cross sell model and planning & forecasting sales of insurance policies. This is promoting the adoption of Insurtech in the sales & marketing application.

Region wise, the Insurtech market share was dominated by North America in 2021, and is expected to maintain this trend during the forecast period. This is attributed to increased adoption of Insurtech among insurance companies and surge in partnership of Insurtech with traditional insurers are the major factors that influence the growth of the market in this region. However, Asia-Pacific is expected to grow at the fastest CAGR during the forecast period, as several insurers are adopting & heavily investing in Insurtech to boost business efficiency, lowering compliance risk exposure and improving claim settlement process in the region.

The Insurtech growth has increased tremendously during the COVID-19 pandemic situation. This is attributed to insurance carriers are accelerating business operations in areas such as digital customer interactions in distribution channel, improving customer service, and hassle-free claims settlements. Moreover, with the help of Insurtech, insurers are able to access remote imaging in assessing underwriting risk & evaluate claims through online channels. Therefore, insurance companies have adopted Insurtech to meet changing customer’s demand, which had a positive impact on the market growth. As a result, these are the major factors promoted the Insurtech market growth during the pandemic situation.

For Purchase Enquiry: https://www.alliedmarketresearch.com/purchase-enquiry/12738

Key Findings of the Study

By technology, the cloud computing segment led the Insurtech industry, in terms of revenue in 2020.

On the basis of application, the claims management segment is expected to exhibit the fastest growth rate during the forecast period.

Region wise, North America generated the highest revenue in 2020.

The top companies in the Insurtech market analysis are Damco Group, DXC Technology Company, Majesco, Oscar Insurance, OutSystems, Quantemplate, Shift Technology, Trov Insurance Solutions, LLC, Wipro Limited, and Zhongan Insurance. These players have adopted various strategies to increase their market penetration and strengthen their position in the Insurtech industry.

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.