Specialized medical chairs can be used for exams, treatments or rehabilitation. These are designed to allow doctor’s access to their patients while meeting the comfort and medical needs of the patient. These devices can be powered manually or through the use of batteries.

Exam chairs, such as those used for childbirth, cardiac procedures, blood draws, dialysis, mammograms, and other procedures, are some examples of frequently used specialized medical chairs. Therapy chair and rehabilitation chair are other types of chairs. Geriatric, pediatric, bariatric, bath, and other chairs are examples of rehabilitation chairs. They will also help with the collection of blood samples, which will aid in the diagnosis of various diseases. For example, a delivery chair helps women maintain a physically upright position during delivery.

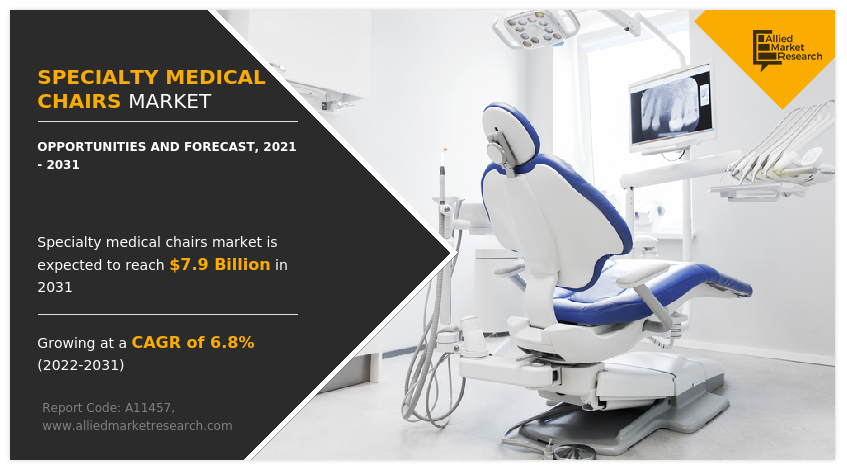

The global specialty medical chairs industry generated $4.1 billion in 2021, and is estimated to reach $7.9 billion by 2031, manifesting a CAGR of 6.8% from 2022 to 2031.

Download Free Sample: https://www.alliedmarketresearch.com/request-sample/11822

- CAGR: 6.8%

- Current Market Size: USD 4.1 Billion

- Forecast Growing Region: APAC

- Largest Market: North America

- Projection Time: 2021 – 2031

- Base Year: 2021

Prime determinants of growth

Increase in the prevalence of chronic diseases, rise in investments in R&D by pharmaceutical companies, and surge in surgical procedures for ophthalmic, dental and ENT disorders drive the growth of the global specialty medical chairs market. However, high cost of specialty medical chairs hinders the market growth. On the other hand, rise in incidence of gynecologic diseases in women and increase in demand for gynecologic examination chairs to examine pregnant women along with rise in demand in emerging economies present new opportunities in the coming years.

Covid-19 Scenario

- The Covid-19 pandemic made a negative impact on the revenue of the specialty medical chairs market. This is due to decline in the number of visits to hospitals and clinics for ophthalmic, dental, and ENT purposes to prevent cross-contamination. This, in turn, reduced the demand for these chairs.

- For instance, Dentsply Sirona highlighted that the net sales lowered by 7.6% for the first quarter of 2020, owing to low patient volumes and postponement of non-urgent procedures. In terms of revenue, the downfall was observed by several companies in the market. However, the demand is expected to recover post-pandemic.

- Manufacturing activities were hindered due to lockdown restrictions and shortage of raw materials. However, the supply chain is expected to recover post-pandemic and manufacturing will continue with full capacity.

The treatment chair segment to maintain its lead position during the forecast period

Based on product, the treatment chair segment accounted for the highest market share in 2021, contributing to more than two-fifths of the global specialty medical chairs market, and is projected to maintain its lead position during the forecast period. Moreover, this segment is projected to manifest the largest CAGR of 7.3% from 2022 to 2031. This is due to rise in the prevalence of ophthalmic disorders and surge in the number of visits to dental clinics. The research also analyzes the segments including examination chair and rehabilitation chair.

Speak to our Analyst: https://www.alliedmarketresearch.com/connect-to-analyst/11822

The electric chairs segment to continue its dominant share throughout the forecast period

Based on type, the electric chairs segment contributed to the highest market share in 2021, accounting for nearly three-fifths of the global specialty medical chairs market, and is projected to continue its dominant share throughout the forecast period. Moreover, this segment is estimated to manifest the highest CAGR of 7.2% from 2022 to 2031. This is attributed to rise in demand for high-quality electronic chair and increase in awareness related to the usage of electronic wheelchair and electromechanical systems that have safety precaution settings such as actuators that lock the chair in place in the event of sudden power loss to prevent accidents. The report also analyzes the manual chairs segment.

The hospitals segment to continue its highest contribution throughout the forecast period

According to End User, the hospital segment accounted for the largest market share in 2021, with nearly half of the global medical specialty chairs market, and is estimated to continue its largest contribution during the forecast period. Additionally, this segment is projected to experience the fastest CAGR of 7.6% from 2022 to 2031. This is due to the growing number of hospitals increasing the demand for specialized medical chairs such as delivery chairs, dialysis chairs and rehabilitation chairs that serve specific purposes based on their application. The research also examines segments that include clinics and others.

North America to maintain its leadership status throughout the forecast period

On a regional basis, North America held the largest market share in 2021, accounting for approximately two-fifths of the global specialty medical chair market, and will maintain its leading status throughout the forecast period. This is attributed to the high adoption of technologically advanced specialist medical chairs, the increase in the number of private clinics and hospitals as healthcare spending increases, and the presence of key players in the market. However, Asia-Pacific is projected to grow at a maximum CAGR of 7.8% between 2022 and 2031, due to improved medical infrastructure which has increased the demand for specialist medical chairs in countries like India.

Leading Market Players

- A-Dec, Inc.

- Craftsmen Contour Equipment Inc.

- Danaher Corporation

- Dentalez, Inc.

- Dentsply Sirona

- Diplomat Dental

- Henry Schein

- Midmark Corporation

- Planmeca OY

- XO Care A/S