A lead analyst at AMR highlighted that the Robo advisory market across Asia-Pacific is anticipated to achieve the highest CAGR during the forecast period.

Get a PDF Sample:

https://www.linkedin.com/feed/update/urn:li:activity:7008338304395800576

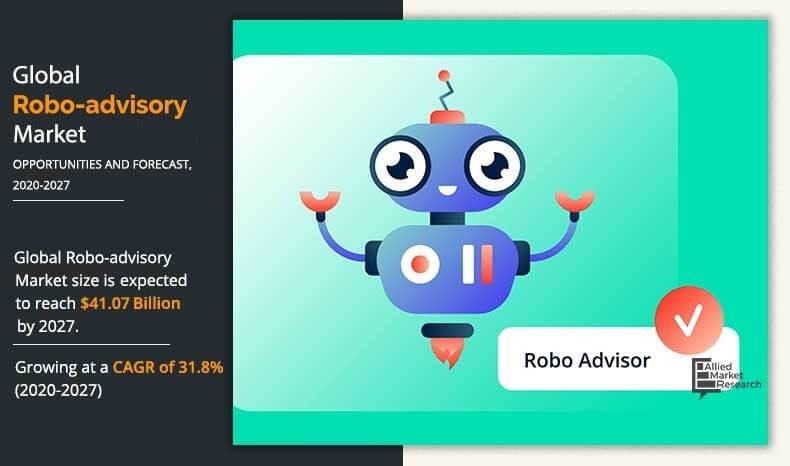

Allied Market Research published a research report on the Robo advisory market. The findings of the report state that the global market for Robo advisory generated $4.51 billion in 2019, and is projected to reach $41.07 billion by 2027, witnessing a CAGR of 31.8% from 2020 to 2027. The report offers valuable information on changing market dynamics, major segments, top investment pockets, and competitive scenarios for market players, investors, shareholders, and new entrants.

Download Sample Report:

The report provides detailed insights on the drivers, restraints, and opportunities to help the market players in devising several growth strategies. The rise in the adoption of advanced technologies, the increasing trend of digitization in financial institutions, and favorable government initiatives drive the growth of the Robo advisory market. However, issues associated with security & compliance impede market growth. On the other hand, technological innovations and potential in developing countries provide prolific growth opportunities for the industry in the coming years.

The report provides a detailed scenario of the impact of the Covid-19 pandemic on the Robo advisory market globally. The outbreak of the COVID-19 pandemic led to the extensive adoption of robo-advisors for wealth and assets management, owing to the completely virtualized offerings by robo-advisors during lockdowns across countries. These advisors prevent investors from illogical and impulsive decision-making and offer huge exposure to individuals to gain expertise in diversification & management of their portfolio by investing in stocks, bonds, and certificates of deposit (CD). This is why the demand for these services grew during the pandemic.

“The bank’s segment is expected to experience significant growth in the coming years, owing to the growing adoption of digital services among the banks to provide enhance customer experience and to upsurge their market value,” said Pramod Borasi, Research Analyst, BFSI at Allied Market Research.

The report offers a detailed segmentation of the global Robo advisory market based on the business model, service provider, service type, end user, and region. These insights are helpful for new as well as existing market players to capitalize on the fastest-growing and largest revenue-generating segments to accomplish growth in the future.

Based on the business model, the hybrid robo-advisors segment was the largest market in 2019, grabbing nearly four-fifths of the global robo-advisory market share and would dominate through 2027. The same segment is anticipated to grow at the fastest CAGR of 32.6% during the forecast period.

Based on end users, the HNIs segment held the largest share of around two-thirds of the global Robo advisory market in 2019 and is likely to lead the trail during the forecast period. However, the retail segment is expected to achieve the fastest CAGR of 33.6% during the forecast period.

Based on region, the Robo advisory market across North America held the largest share in 2019, garnering more than half of the global Robo advisory market, and would maintain its dominance through 2027. However, the market in the Asia-Pacific region is expected to grow at the highest CAGR of 34.8% during the forecast period.

The leading market players analyzed in the global Robo advisory market report include Betterment, Charles Schwab Corporation, Blooom, Personal Capital Corporation, FMR LLC, SIGFIG, SoFi, Wealthfront Corporation, The Vanguard Group, Inc., and WiseBanyan, Inc.

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to offer business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains.

Contact us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: 1-800-792-5285 |UK: +44-845-528-1300 | Hong Kong: +852-301-84916 | India (Pune): +91-20-66346060|Fax: +1-855-550-5975

Email: help@alliedmarketresearch.com.

Follow us on LinkedIn, Twitter, Facebook, Pinterest, YouTube & Instagram.