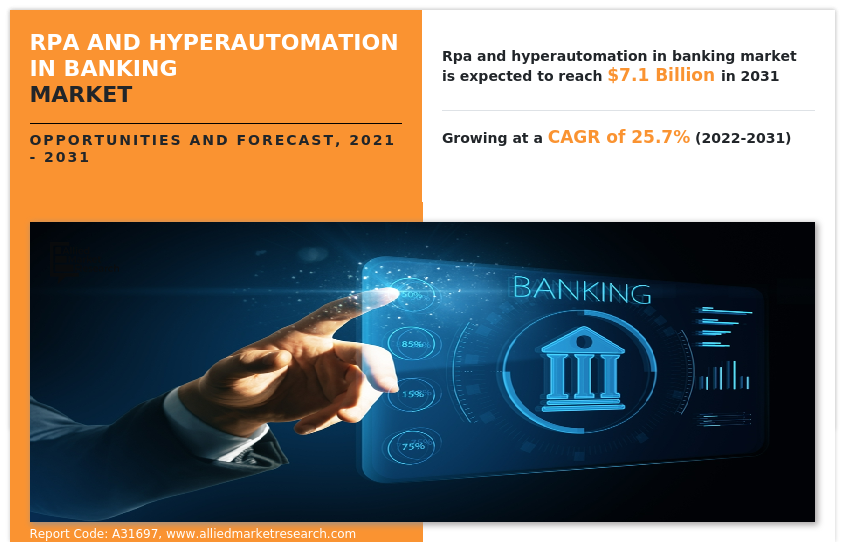

RPA and Hyperautomation in Banking Market by Component (Solution, Services), by Deployment Mode (On-Premise, Cloud), by Organization Size (Large Enterprises, Small and Medium-sized Enterprises), by Application (Customer Account Management, Fraud Prevention, Report and Invoice Automation, Account Opening and KYC, Auditing and Compliance, Chatbots, Others): Global Opportunity Analysis and Industry Forecast, 2021-2031.

The demand for RPA and hyperautomation in banking market is increasing due to rapid development in the automation of banking industry. By eliminating repetitive and laborious tasks, banking institutions allow their employees to work more efficiently and focus on other core tasks with the help of automation.

In addition, another benefit of hyperautomation is that it can save both time and money and rapid growth in digital banking services are driving the growth of the market. However, process standardization and organizational difficulties for implementing RPA and security and privacy concerns have emerged as key industry problems in RPA and hyperautomation in banking market.

Download Report Sample PDF : https://www.alliedmarketresearch.com/request-sample/32147

On the contrary, technological advancement in the field of banking will further give major opportunity for the RPA and hyperautomation in banking market growth.

The report focuses on growth prospects, restraints, and trends of the RPA and hyperautomation in banking market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors, such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers, on the RPA and hyperautomation in banking market size.

Based on deployment mode, the on-premise segment attained the highest growth in 2021. This is attributed to the fact that the on-premise deployment mode is considered widely useful in large banks and institutions, as it involves a significant investment to implement, and organizations need to purchase interconnected servers as well as software to manage the system.

Top impacting factors

Rapid development in the automation of banking industry

Process standardization and organizational difficulties for implementing RPA

Technological advancement in the field of banking

Connect Analyst : https://www.alliedmarketresearch.com/connect-to-analyst/32147

Key benefits for stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the RPA and hyperautomation in banking market forecast from 2021 to 2031 to identify the prevailing RPA and hyperautomation in banking market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter’s five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the RPA and hyperautomation in banking market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global RPA and hyperautomation in banking market outlook, key players, market segments, application areas, and market growth strategies.

RPA and Hyperautomation in Banking Market Report Highlights

| Aspects | Details |

|---|---|

| Market Size By 2031 | USD 7.1 billion |

| Growth Rate | CAGR of 25.7% |

| Forecast period | 2021 – 2031 |

| Report Pages | 252 |

| Component | SolutionServices |

| Deployment Mode | On-PremiseCloud |

| Organization Size | Large EnterprisesSmall and Medium-sized Enterprises |

| Application | Customer Account ManagementFraud PreventionReport and Invoice AutomationAccount Opening and KYCAuditing and ComplianceChatbotsOthers |

| By Region | North America (U.S., Canada)Europe (UK, Germany, France, Italy, Spain, Rest of Europe)Asia-Pacific (China, Japan, India, Australia, South Korea, Rest of Asia-Pacific)LAMEA (Latin America, Middle East, Africa) |

| Key Market Players | Antworks, Aspire Systems, Atos SE, Automation Anywhere, Inc., Blue Prism Limited, eccenca GmbH, IBM, itrex group, Protiviti Inc., UiPath |

Request Customization : https://www.alliedmarketresearch.com/request-for-customization/32147

Related Reports:

- Commercial Banking Market: https://www.alliedmarketresearch.com/commercial-banking-market-A06184

- Open Banking Market : https://www.alliedmarketresearch.com/open-banking-market

- Banking Encryption Software Market: https://www.alliedmarketresearch.com/banking-encryption-software-market-A11824

- Core Banking Solutions Market: https://www.alliedmarketresearch.com/core-banking-solutions-market-A08726

- Online Banking Market: https://www.alliedmarketresearch.com/online-banking-market

- Retail Banking Market : https://www.alliedmarketresearch.com/retail-banking-market

- Investment Banking Market: https://www.alliedmarketresearch.com/investment-banking-market-A06710

- Merchant Banking Services Market: https://www.alliedmarketresearch.com/merchant-banking-services-market-A06931

- Banking CRM Software Market: https://www.alliedmarketresearch.com/banking-crm-software-market-A07431

- Corporate Banking Market: https://www.alliedmarketresearch.com/corporate-banking-market-A07536

- Banking Cloud Services Market: https://www.alliedmarketresearch.com/banking-cloud-services-market-A07600

- Banking Security Market: https://www.alliedmarketresearch.com/banking-security-market-A08279

- Banking Credit Analytics Market : https://www.alliedmarketresearch.com/banking-credit-analytics-market-A10394

- Digital Process Automation (DPA) Software in Banking Market: https://www.alliedmarketresearch.com/digital-processing-automation-software-in-banking-market-A12741

- Intelligent Virtual Assistant (IVA) Based Banking Market: https://www.alliedmarketresearch.com/intelligent-virtual-assistant-based-banking-market-A12745

- Cloud Computing Banking Market: https://www.alliedmarketresearch.com/cloud-computing-banking-market-A12967

- Smart Machines in Banking Market: https://www.alliedmarketresearch.com/smart-machines-in-banking-market-A14683

- E-Banking Market: https://www.alliedmarketresearch.com/e-banking-market-A15165

- Electronic Data Interchange in Banking Market: https://www.alliedmarketresearch.com/electronic-data-interchange-in-banking-market-A15169

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com