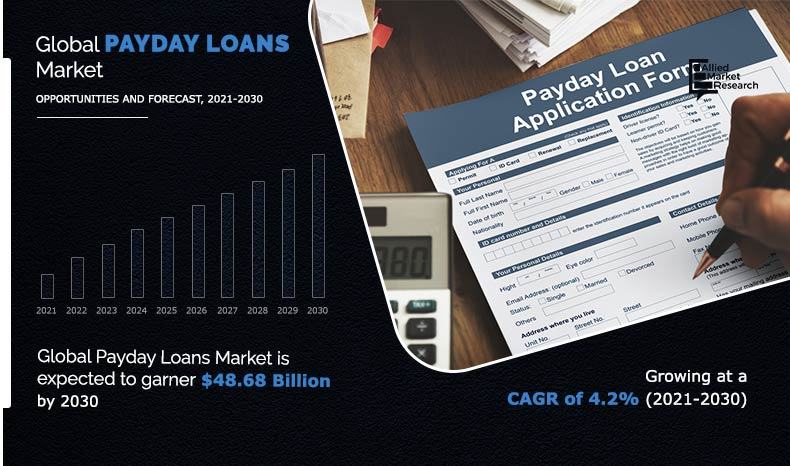

As per the report published by Allied Market Research, the global payday loans market generated $32.48 billion in 2020, and is expected to reach $48.68 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030.

Download Free Sample Report : https://rb.gy/riolmp

Rise in awareness regarding payday loans among youth population and fast loan approval with no restriction on usage drive the growth of the global payday loans market. However, high-interest rates hinder the market growth. On the other hand, rise in adoption of advanced technology among payday lenders and presence of a large number of payday lenders are expected to open lucrative opportunities for the market players in the future.

Covid-19 Scenario:

- The Covid-19 pandemic affected millions of people due to rise in unemployment and financial hardships. As payday is only available to employed people with a steady source of income, the market growth reduced during the pandemic.

- Decline in support from NGOs and reduction in payday loans government schemes affected the market negatively.

Interested to Procure the Data? Inquire here @: https://rb.gy/wa8crr

The report segments the global payday loans market on the basis of type, marital status, brokerage type, and region.

Based on type, the report is divided into storefront payday loans and online payday loans. The storefront payday loans segment held the largest share in 2020, accounting for nearly three-fifths of the market. However, the online payday loans segment is projected to register the highest CAGR of 5.7% during the forecast period.

On the basis of marital status, the report is classified into married and single. The single segment held the largest share in 2020, contributing to more than two-thirds of the market. However, the married segment is estimated to manifest the highest CAGR of 5.8% from 2021 to 2030.

The global payday loans market is analyzed across several regions such as North America, Europe, Asia-Pacific, and LAMEA. The market across North America held the lion’s share in 2020, accounting for more than two-fifths of the market. However, Asia-Pacific is anticipated to portray the highest CAGR of 6.2% during the forecast period.

The global payday loans market includes an in-depth analysis of the prime market players such as Cashfloat, Creditstar, CashNetUSA, Myjar, Lending Stream, Speedy Cash, Silver Cloud Financial, Inc., Titlemax, THL Direct, and TMG Loan Processing.

Avenue is a user-based library of global market report database, provides comprehensive reports pertaining to the world’s largest emerging markets. It further offers e-access to all the available industry reports just in a jiffy. By offering core business insights on the varied industries, economies, and end users worldwide, Avenue ensures that the registered members get an easy as well as single gateway to their all-inclusive requirements.

Request Customization : https://rb.gy/o38fyc

Top Impacting Factors

Growing Awareness about the Payday Loan among the Youth Population

Large Number of Payday Lenders

Payday Loans Market Report Highlights

| Aspects | Details |

|---|---|

| BY TYPE | STOREFRONT PAYDAY LOANSONLINE PAYDAY LOANS |

| BY MARITAL STATUS | MARRIEDSINGLEOthers |

| BY CUSTOMER AGE | LESS THAN 2121 TO 3031 TO 4041 TO 50MORE THAN 50 |

| BY REGION | NORTH AMERICA (US, Canada)EUROPE (UK, Germany, France, Italy, Spain, Netherlands, Rest of Europe)ASIA PACIFIC (China, India, Japan, South Korea, Australia, Rest of Asia Pacific)LAMEA (Latin America, Middle East, Africa) |

| Key Market Players | CASHFLOAT, CASHNETUSA, CREDITSTAR, LENDING STREAM, MYJAR, SILVER CLOUD FINANCIAL, INC, SPEEDY CASH, THL DIRECT, TITLEMAX, TMG LOAN PROCESSING |

Related Links:

Personal Loans Market: https://www.alliedmarketresearch.com/personal-loans-market-A07580

Payday Loans Market : https://www.alliedmarketresearch.com/payday-loans-market-A10012

Trade Loans Services Market : https://www.alliedmarketresearch.com/trade-loan-services-market-A08281

Loan Origination Software Market: https://www.alliedmarketresearch.com/loan-origination-software-market-A15124

Property Loan Market: https://www.alliedmarketresearch.com/property-loan-market-A15131

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: www.alliedmarketresearch.com

Allied Market Research Blog: https://blog.alliedmarketresearch.com