Rise in awareness regarding payday loans among youth population and fast loan approval with no restriction on usage drive the growth of the global payday loans market. The market across North America held the lion’s share in 2020, accounting for more than two-fifths of the market. The Covid-19 pandemic affected millions of people due to rise in unemployment and financial hardships.

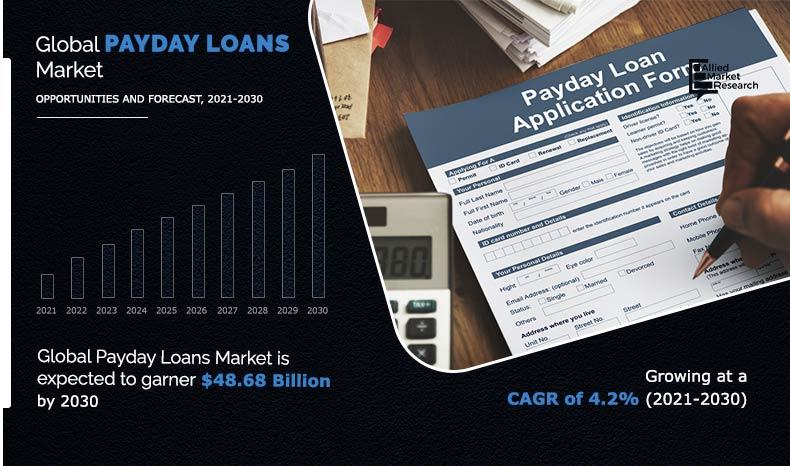

As per the report published by Allied Market Research, the global payday loans market generated $32.48 billion in 2020, and is expected to reach $48.68 billion by 2030, growing at a CAGR of 4.2% from 2021 to 2030.

Download Free Sample Report (Get Detailed Analysis in PDF – 280 Pages): https://www.alliedmarketresearch.com/request-sample/10377

Rise in awareness regarding payday loans among youth population and fast loan approval with no restriction on usage drive the growth of the global payday loans market. However, high-interest rates hinder the market growth. On the other hand, rise in adoption of advanced technology among payday lenders and presence of a large number of payday lenders are expected to open lucrative opportunities for the market players in the future.

Interested to Procure the Data? Inquire here @: https://www.alliedmarketresearch.com/purchase-enquiry/10377

The report segments the global payday loans market on the basis of type, marital status, brokerage type, and region.

Based on type, the report is divided into storefront payday loans and online payday loans. The storefront payday loans segment held the largest share in 2020, accounting for nearly three-fifths of the market. However, the online payday loans segment is projected to register the highest CAGR of 5.7% during the forecast period.

On the basis of marital status, the report is classified into married and single. The single segment held the largest share in 2020, contributing to more than two-thirds of the market. However, the married segment is estimated to manifest the highest CAGR of 5.8% from 2021 to 2030.

The global payday loans market is analyzed across several regions such as North America, Europe, Asia-Pacific, and LAMEA. The market across North America held the lion’s share in 2020, accounting for more than two-fifths of the market. However, Asia-Pacific is anticipated to portray the highest CAGR of 6.2% during the forecast period.

The global payday loans market includes an in-depth analysis of the prime market players such as Cashfloat, Creditstar, CashNetUSA, Myjar, Lending Stream, Speedy Cash, Silver Cloud Financial, Inc., Titlemax, THL Direct, and TMG Loan Processing.

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

Pawan Kumar, the CEO of Allied Market Research, is leading the organization toward providing high-quality data and insights. We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.