Allied Market Research published a report, titled, “B2B Payments Market By Payment Type (Domestic Payments and Cross-Border Payments), Enterprise Size (Large Enterprises, Medium-Sized Enterprises and Small-Sized Enterprises), Payment Mode (Traditional and Digital), and Industry Vertical (Manufacturing, IT & Telecom, Metals & Mining, Energy & Utilities, BFSI, and Others): Global Opportunity Analysis and Industry Forecast, 2021–2028.” The report offers a detailed analysis of changing market dynamics, key segments, value chain, competitive landscape, top investment pockets, and regional scenario.

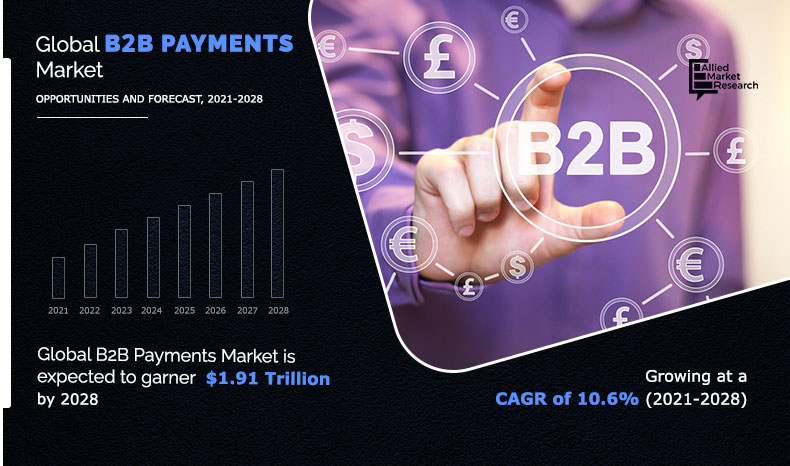

The global B2B payments market size was valued at $870.42 billion in 2020, and is projected to reach $1.91 trillion by 2028, growing at a CAGR of 10.6% from 2021 to 2028.

Access Full Summary @ https://www.alliedmarketresearch.com/b2b-payments-market-A08183

Business-to-business (B2B) payment involves the transaction of value denominated in currency from buyer to supplier for good or services supplied in the market. It benefits firms with easier payment process and accelerates transfers of funds. Furthermore, B2B payments between two entities are influenced by a number of variables, such as frequency, volume, sector, and interest charges, which does not impact customer payments.

The research provides an extensive analysis of driving factors, restraints, and opportunities of the global B2B Payments Market. These insights are helpful in availing insights about drivers, determine strategies, and implement necessary steps to avail competitive advantage and sustainable growth. Moreover, market players, investors, and startups can determine new opportunities, exploit the market potential, and achieve competitive edge.

Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/8548

The report offers a detailed impact of the Covid-19 pandemic on the global B2B Payments Market to assist investors, market players, and others in reassessing their strategies and taking necessary steps accordingly.

Covid-19 Scenario:

- Manufacturing activities of B2B Payments Market were halted due to partial or complete lockdown adopted in many countries. In addition, disruption in the supply chain and unviability of sufficient workforce presented hindrances in manufacturing activities.

- The Covid-19 pandemic presented the economic uncertainty, lowered down business confidence, and surged panic among customers. However, the market is projected to recover soon.

- Post-lockdown, manufacturing activities began with full capacity and supply chain reestablished. Moreover, the demand from end user industries is expected to increase gradually.

Key Market Segments:

- BY PAYMENT TYPE

- Domestic Payments

- Cross-Border Payments

- BY ENTERPRISE SIZE

- Large Enterprises

- Medium-Sized Enterprises

- Small-Sized Enterprises

- BY PAYMENT MODE

- Traditional

- Digital

- BY INDUSTRY VERTICAL

- Manufacturing

- IT & Telecom

- Metals & Mining

- Energy & Utilities

- BFSI

- Others

A comprehensive analysis of each segment and sub-segment is provided in the research. In addition, the tabular and graphical representation of each segment and sub-segment will assist market players in understanding the largest revenue generating segments and driving factors thoroughly. This analysis is valuable in identifying the fastest growing segments as well and strategizing to gain a long-term growth.

The research provides a detailed analysis for various regions and countries for the global B2B Payments Market. Regions discussed in the study include North America (the U.S., Canada, and Mexico), Europe (the U.K., France, Italy, Germany, and rest of Europe), Asia-Pacific (China, Japan, India, Taiwan, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). These insights are valuable in devising strategies of expansion, identifying growth potential, and tapping on opportunities in new regions. AMR also provides customization services for a specific region, country, and segment as per requirements.

Request For Customization @ https://www.alliedmarketresearch.com/request-for-customization/8548

The report provides an extensive analysis of major market players operating in the global B2B Payments Market.

The major market players analyzed in the research include

- American Express

- JPMorgan Chase & Co.

- Mastercard

- PAYONEER INC.

- PAYPAL HOLDINGS, INC.

- PAYSTAND, INC.

- SQUARE, INC.

- Stripe

- TransferWise Ltd.

- VISA, INC.

They have implemented various strategies such as new product launches, mergers and acquisitions, joint ventures, partnerships, expansion, collaborations, and others to gain competitive advantage across the global market.

Top Impacting Factors

Use of Advanced Technology in B2B Payment

B2B payment has been gaining high traction in the current years, owing to advancement in technology, which offers secured and reliable business transactions. Moreover, business owners are shifting toward technology-based B2B payment systems rather than using the traditional method of paying & receiving payments. In addition, automation in the payment system has accelerated its demand among business owners in networking & connecting with various suppliers, wholesalers, and retailers globally.

Automated clearing house (ACH) is a form of B2B payments that is faster & more efficient than the traditional methods. This type of transaction moves electronically from one entity to another using a routing number and bank accounts. Therefore, technological advancements in the field of B2B payment are projected to propel the market growth during the forecast period.

Get Exclusive Discount: https://www.alliedmarketresearch.com/purchase-enquiry/8548

Top Trending Reports:

1) U.S. Insurance Third Party Administrator Market

Pre-Book Now With 10% Discount:

2) LAMEA Travel Insurance Market

3) E-passport and E-visa Market

About Us:

Allied Market Research (AMR) is a full-service market research and business consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com