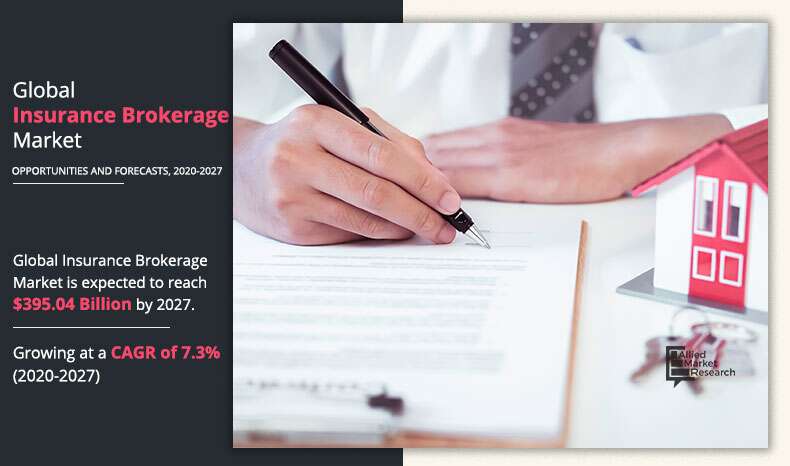

Insurance Brokerage Market Analysis by Revenue Generation, Development Strategy, Regional Segmentation, Key Trend and Value Share

ACCESS COMPLETE REPORT: https://www.alliedmarketresearch.com/insurance-brokerage-market-A10350

The market study incorporates an in-depth analysis of the Insurance Brokerage Market based on the key parameters that take in the drives, sales inquiry, market extents & share. Moreover, the report provides a detailed measurements about the drivers, growth, and opportunities that have a direct influence on the market. The report, further, focuses on assessing the market size of four major regions, namely North America, Europe, Asia-Pacific, and LAMEA. The research study is designed to help the readers with an exhaustive valuation of the current industry trends and analysis.

The report spans the Insurance Brokerage research data of various companies, benefits, gross margin, strategic decisions of the worldwide market, and more through tables, charts, and infographics.

DOWNLOAD FREE SAMPLE REPORT: https://www.alliedmarketresearch.com/request-sample/10715

Other important factors studied in this report include demand and supply dynamics, industry processes, import & export scenarios, R&D development activities, and cost structures. Besides, consumption demand and supply figures, cost of production, and selling price of products are also estimated in this report.

The Study Will Help the Readers:

- Acknowledge the complete market dynamics.

- Inspect the competitive scenario along with the future market landscape with the help of different strictures such as Porter’s five forces and parent/peer market.

- Understand the impact of government regulations during the Covid-19 pandemic and evaluate the market throughout the global health crisis.

- Consider the portfolios of the major market players operational in the market coupled with the comprehensive study of the products and services they offer.

Main Offerings-

- The report crafted by AMR on the Insurance Brokerage Market doles out a wide-ranging study of global market share, key determinants of the growth, country-level stance, segmental assessment, market prospects, and the major trends.

- Porter’s five forces model, on the other hand, cites the efficacy of buyers & sellers, which is important to help the market players implement fruitful stratagems. Furthermore, the research study includes

- Threat of new competitors

- Threat of new stand-ins

- Bargaining clout of suppliers as well as consumers

- Rivalry among key players

- An explicit analysis of the driving and restraining factors of the global Insurance Brokerage Market is also provided in the report.

GET EXCLUSIVE DISCOUNT: https://www.alliedmarketresearch.com/purchase-enquiry/10715

The Insurance Brokerage Market also focuses on the key players operating in the sector. Their product portfolio, business tactics, company profiles, and revenue share are also perfectly delineated in the report. Finally, the study delineates the strategies such as partnership, expansion, collaboration, joint ventures, and others implemented by the frontrunners to heighten their status in the sector.

Top Market Players Change the View of the Global Face of Insurance Brokerage Industry: Acrisure, LLC, Aon plc, Brown & Brown, Inc, Gallagher, HUB International Limited, Lockton companies, Marsh & McLennan Companies Inc., Truist Insurance Holdings, USI Insurance Services L.L.C, and Willis Towers Watson.

COVID-19 Scenario-

The research study showcases the thorough impact analysis of COVID-19 on the global Insurance Brokerage Market. The unprecedented situation had distressed the global economy and the Insurance Brokerage Market was impacted badly, especially during the initial phase. The report also takes in the details about the market extents during this pandemic. Moreover, the study provides a large-scale study of the policies & plans executed by the key players all over this term. At the same time, it also cites the post-pandemic scenario, since the majority of government bodies have come up with slackening measures on the existing rules, when major vaccination drives have also been initiated across the world. With this drift on board, the global Insurance Brokerage Market is projected get back on track very soon.

COVID-19 IMPACT ANALYSIS/CUSTOMIZATION: https://www.alliedmarketresearch.com/request-for-customization/10715?reqfor=covid

Key Market Segments

- By Insurance Type

- Life Insurance

- Property & Casualty Insurance

- By Brokerage Type

- Retail Brokerage

- Wholesale Brokerage

Top Trending Reports

1) Financial Advisory Services Market

2) Digital Insurance Platform Market

Pre-Book Now With 10% Discount:

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact Us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

1-800-792-5285, 1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975

help@alliedmarketresearch.com

Web: https://www.alliedmarketresearch.com

Follow Us on LinkedIn and Twitter