The market study provides an ultimate guide to the current market trends and highlights an in-depth statistic about the drivers, restraints, and opportunities that have a straight impact on the global Supply Chain Finance market. These insights shower necessary guidance to determine driving factors and implement strategies to gain a sustainable growth and tap on opportunities to explore the potential of the market. Porters’ Five Forces and SWOT analysis throw light on the financial aspects that businesses need to focus on to formulate their growth strategies.

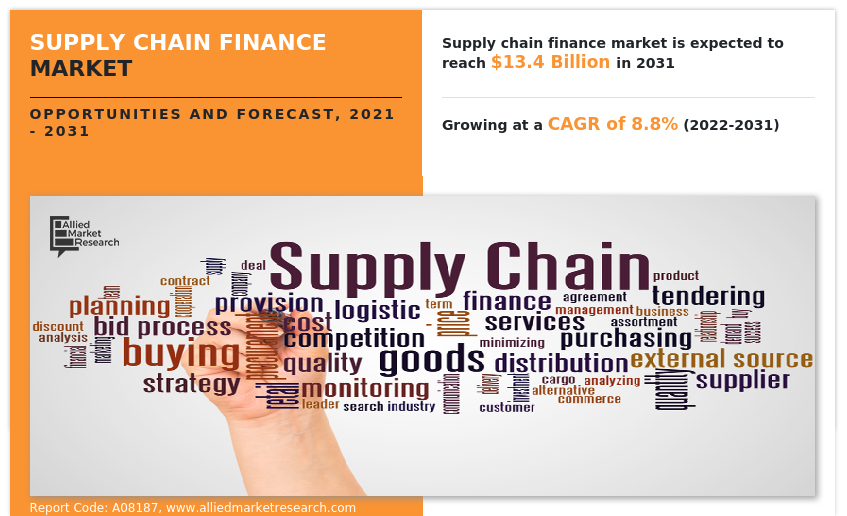

The global supply chain finance market was valued at $6 billion in 2021, and is projected to reach $13.4 billion by 2031, growing at a CAGR of 8.8% from 2022 to 2031.

Download Sample Report @ https://www.alliedmarketresearch.com/request-sample/8552

Report coverage & details:

| Report Coverage | Details |

| Forecast Period | 2022–2031 |

| Base Year | 2021 |

| Market Size in 2021 | $6 billion |

| Market Size in 2031 | $13.4 billion |

| CAGR | 8.8% |

| No. of Pages in Report | 301 |

| Segments Covered | Offering, Provider, Application, End User, and Region. |

| Drivers | Surge in acceptance of supply chain finance in emerging economies. |

| Rise in competition in supply chain finance business and new agreements pertaining to supply chain finance domain. | |

| Opportunities | Integration of blockchain technology in online supply chain finance business activities. |

| Restraints | Increase in trade conflicts and high implementation costs. |

By region, the Supply Chain Finance market is assessed across North America (Canada, Mexico, and the United States), Europe (France, Italy, Germany, Spain, the United Kingdom, and rest of Europe), Asia-Pacific (Australia, Japan, South Korea, China, India, and rest of Asia-Pacific), and LAMEA (Africa, the Middle East, and Latin). America).

Covid-19 Scenario:

- The outbreak of the COVID-19 pandemic had a negative impact on the growth of the global Supply Chain Finance market, owing to a significant reduction in demand from end-use industries.

- The global health crisis not only disrupted production facilities and supply chain, but also disturbed the global economy altogether.

- Nevertheless, with the emergence of vaccines such as Covaxin, Covishield, and Sputnik, the global situation has gotten back to normalcy and the global Supply Chain Finance market is anticipated to get back on track really soon.

The report offers a detailed segmentation of the global supply chain finance market based on offering, provider, application, end user, and region. The report provides a comprehensive analysis of every segment and their respective sub-segment with the help of graphical and tabular representation. This analysis can essentially help market players, investors, and new entrants in determining and devising strategies based on the fastest-growing segments and highest revenue generation that is mentioned in the report.

Based on offering, the export and import bills segment held the major market share in 2021, holding nearly two-fifths of the global supply chain finance market share, and is expected to maintain its leadership status during the forecast period. However, the shipping guarantees segment, is expected to cite the fastest CAGR of 13.1% during the forecast period.

On the basis of provider, the banks segment held the largest market share in 2021, accounting for nearly 90% of the global supply chain finance market share, and is expected to maintain its leadership status during the forecast period. Nevertheless, the trade finance house segment, is expected to cite the highest CAGR of 14.2% during the forecast period.

In terms of application, the domestic segment held the major market share in 2021, contributing to nearly fourth-fifths of the global supply chain finance market share, and is expected to maintain its leadership position during the forecast period. However, the international segment, is expected to cite the fastest CAGR of 11.6% during the forecast period.

Based on end user, the large enterprises segment held the major market share in 2021, contributing to nearly two-thirds of the global supply chain finance market share, and is expected to maintain its leadership position during the forecast period. However, the small and medium-sized enterprises segment, is expected to cite the fastest CAGR of 11.2% during the forecast period.

Region-wise, the Asia-Pacific region held the major market share in 2021, holding over two-fifths of the global supply chain finance market share and is expected to maintain its leadership status during the forecast period. Moreover, the same segment is expected to cite the fastest CAGR of 11.5% during the forecast period. The report also analyses other regions such as North America, Europe, and LAMEA.

The report analyzes these key players in the global supply chain finance market. These market players have made effective use of strategies such as joint ventures, collaborations, expansion, new product launches, partnerships, and others to maximize their foothold and prowess in the industry. The report is helpful in analyzing recent developments, product portfolio, business performance, and operating segments by prominent players in the market.

Key Takeaways of the Report:

- An explanatory portrayal of the global Supply Chain Finance market coupled with the current drifts and future estimations to facilitate the investment pockets.

- Major revenue generating segment together with regional trends & opportunities.

- Qualitative valuation of market drivers, challenges, opportunities, and trends.

- Governing procedures and development bents.

- Company portfolios along with their investment plans and financial specifics.

- Valuation of recent policies & developments and their impact on the market.

Key Stakeholders:

- Top players operating in the industry

- Governments Agencies

- Distributors

- Suppliers

- C-level Officials

- Venture Entrepreneurs

Interested to Procure the Data? Inquire Here: https://www.alliedmarketresearch.com/purchase-enquiry/8552

Key Market Players:

The Global Supply Chain Finance market report highlights the frontrunners operating in the industry which include:

- Asian Development Bank

- BNP Paribas

- Bank of America Corporation

- Citigroup Inc.

- Eulers Herms (Allianz Trade)

- HSBC Group

- JPMorgan Chase & Co.

- Mitsubishi UFJ Financial Group Inc.

- Royal Bank of Scotland Plc

- Standard Chartered

Their company profiles, relative share, product selection, business slants, and revenue share are properly delineated in the study.

The report provides a detailed analysis of these key players of the global grease market. These players have adopted different strategies such as new product launches, collaborations, expansion, joint ventures, agreements, and others to increase their market share and maintain dominant shares in different regions. The report is valuable in highlighting business performance, operating segments, product portfolio, and strategic moves of market players to showcase the competitive scenario.

Trending Reports in BFST Industry:

About Us:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to provide business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domain.

We are in professional corporate relations with various companies and this helps us in digging out market data that helps us generate accurate research data tables and confirms utmost accuracy in our market forecasting. Allied Market Research CEO Pawan Kumar is instrumental in inspiring and encouraging everyone associated with the company to maintain high quality of data and help clients in every way possible to achieve success. Each and every data presented in the reports published by us is extracted through primary interviews with top officials from leading companies of domain concerned. Our secondary data procurement methodology includes deep online and offline research and discussion with knowledgeable professionals and analysts in the industry.

Contact:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

USA/Canada (Toll Free):

+1-800-792-5285, +1-503-894-6022

UK: +44-845-528-1300

Hong Kong: +852-301-84916

India (Pune): +91-20-66346060

Fax: +1(855)550-5975