Increase in cybercrime cases, surge in adoption of digital payments, and rise in the number of credit card users drive the growth of the global identity theft insurance market.

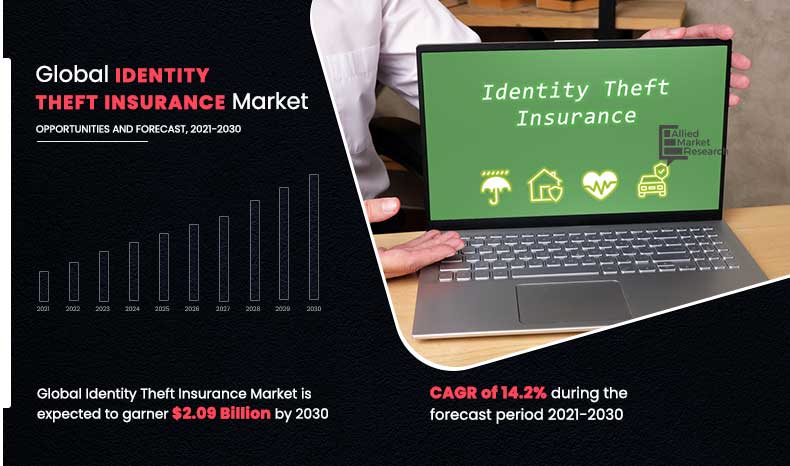

Allied Market Research published a research report on the identity theft insurance market. The findings of the report state that the global identity theft insurance market generated $0.57 billion in 2020, and is expected to garner $2.09 billion by 2030, witnessing a CAGR of 14.2 % from 2021 to 2030. The report offers valuable information on evolving market trends, major segments, top investment pockets, and key competitors for market players, investors, shareholders, and new entrants.

Download Sample Report: https://www.linkedin.com/feed/update/urn:li:activity:6942470970628546560

Pramod Borasi, the Research Analyst, BFSI at Allied Market Research, outlined, “With increasing cybercrimes and data breaches, identity theft insurance delivers convenient and secure insurance cover to the customer to protect their digital identity in the growing trend of digitalization.”

Get a PDF Sample: https://www.facebook.com/alliedmarketresearch/posts/pfbid02XQhreoJ5pjEvKe9WmoczL9r698xPYtdBDMWK8K6FGgLaRNS1qtjz1zDgZHXb8wzNl

The report offers an in-depth analysis of drivers, restraints, and opportunities to help market players in devising strategies and capitalizing on potential market opportunities. Increase in cybercrime cases, surge in adoption of digital payments, and rise in the number of credit card users drive the growth of the global identity theft insurance market. However, lack of customer awareness hampers the market growth. On the contrary, surge in online platform users, increased digitalization in developing countries, and rise in importance of privacy offer new opportunities for the market growth.

Request for Sample Pages: https://twitter.com/Allied_MR/status/1536708026857848833

The research provides a detailed scenario regarding the impact of the Covid-19 pandemic on the identity theft insurance market across the globe. The outbreak of Covid-19 positively affected the global identity theft insurance market. This is owing to the increased use and adoption of online and digitalized platforms among customers across the globe. As consumers are becoming more aware of the risks associated with electronic identification technologies available in the market, the cost of identity theft insurance is skyrocketing.

The report offers detailed segmentation of the global identity theft insurance market based on type, application, and region. These insights are helpful for new as well as existing market players to capitalize on the fastest growing and largest revenue generating segments to accomplish growth in the future.

By type, the credit card fraud segment dominated the market share in 2020, contributing to around two-fifths of the global identity theft insurance market, and is expected to maintain its leadership status throughout the forecast period. Rise in credit card fraud incidences due to digitization is proving beneficial for the growth of identity theft insurance market. However, the bank fraud segment is anticipated to witness the highest CAGR of 18.6% from 2021 to 2030, due to increase in digital usage in the banking industry.

By application, the individuals segment held the largest market share in terms of revenue in 2020, accounting for more than half of the global identity theft insurance market, and is expected to continue its dominance throughout the forecast period. This is owing to increase in cases of personal data theft on social media. However, the business segment is anticipated to grow with the fastest CAGR of 15.5% from 2021 to 2030. Traditional tactics include duplicating a company’s letterhead or delivering forged communications, but relatively new and more sophisticated methods are being developed. As a result, the demand for identity insurance has increased in recent years by business firms.

By region, North America lead the market share in terms of revenue in 2020, contributing to more than two-fifths of the global identity theft insurance market, due to developed digitalized platform. However, the Asia-Pacific region is anticipated to portray the fastest CAGR of 17.8% during the forecast period. This is owing to the rapid speed of digital adoption, along with speedy development of the digital ecosystem.

Leading players of the global identity theft insurance market analyzed in the research includeAura, Allstate Insurance Company, Experian, Chubb, IdentityForce, Inc., GEICO, IDShield, NortonLifeLock, McAfee, LLC, and Nationwide Mutual Insurance Company.

About Allied Market Research:

Allied Market Research (AMR) is a full-service market research and business-consulting wing of Allied Analytics LLP based in Portland, Oregon. Allied Market Research provides global enterprises as well as medium and small businesses with unmatched quality of “Market Research Reports” and “Business Intelligence Solutions.” AMR has a targeted view to offer business insights and consulting to assist its clients to make strategic business decisions and achieve sustainable growth in their respective market domains.

Contact us:

David Correa

5933 NE Win Sivers Drive

#205, Portland, OR 97220

United States

Toll Free: 1-800-792-5285 |UK: +44-845-528-1300 | Hong Kong: +852-301-84916 | India (Pune): +91-20-66346060|Fax: +1-855-550-5975

Email: help@alliedmarketresearch.com.

Follow us on LinkedIn ,Twitter, Facebook, Pinterest, YouTube & Instagram.